Stock Market Basics

What is a stock?

So, you have decided to invest in stocks. Congratulations! But what actually is a stock, what do you get when you buy one, and where does its value come from?

A stock is a type of financial security that represents part ownership of a business. Units of stock are called shares, and when you buy a stock you become a shareholder.

This means you are given all the rights and benefits that come with owning a business, including a right to a share of the company's assets and profit, receive dividends, and participate and vote in AGMs.

A stock is a financial security represents part ownership of a business.

By voting, you genuinely have a say in important decisions the business has to make. However, most of the time individual investors like you and I simply do not hold enough shares to influence the outcome of votes. It is usually large shareholders such as hedge funds or the founders themselves that influence the outcome. Voting is optional. Personally, I have never bothered to vote in an AGM, but feel free to do so if that's what floats your boat!

The value of a stock is tied to the assets and profit of the underlying company.

The main source of a stock's value is the attached rights to the assets and profit of the underlying company. When the company makes more money and its assets grow, the value of its stock will go up.

A common analogy for visualising the relationship between a company and its shares is a pie sliced up into many tiny slices, where each share is a single one of those slices. The share price changes when the area of the pie gets bigger or smaller.

But investors are not just interested in how much money the company made yesterday. Investors are interested in how much money the company will make tomorrow. This is where the uncertainty comes in. Share prices can fluctuate significantly as investors continuously digest new information and attempt to determine exactly how much money will be made in the future and therefore how valuable the company is.

Fundamental analysis is the process of analysing the qualitative and quantitative aspects of the underlying businesses in order to predict how much money it will make in the future and therefore how much the stock is worth (called intrinsic value).

Experts dedicate their lives determining how much stocks are worth. If you can determine the intrinsic value of a stock, making money becomes pretty easy. Just buy when the price is below intrinsic value and sell when it is above. Unfortunately, there are many moving parts and accurately determining intrinsic value is extremely difficult. But that's part of the fun. If it was easy, everyone would be a millionaire.

Rewarding Shareholders

Businesses can reward shareholders by returning capital (a fancy word for money) through dividends and share buybacks.

A dividend is the portion of the company's earnings that it chooses to pay to its shareholders. Companies can choose to pay dividends as frequently as they like, but if they pay a dividend it is usually every quarter or six months.

You automatically receive dividends for the shares you own to your broker account or nominated bank account.

Initial Public Offerings (IPO)

The stocks you buy on the stock market belong to public companies. This means that anyone, like you and I, can buy shares in them if we want to. This is opposed to private companies, whose shares are usually owned by a small number of people like its founders, venture capitalists, and angel investors, and are not available to purchase publicly. Think of your local cafe or restaurant, these are almost certainly private companies. Many businesses stay private because it affords the owners tighter control, incurs lower administration costs, and does not subject them to public scrutiny.

When businesses become large enough, they have the option to go public with an event called an Initial Public Offering (IPO) or float. At the IPO, the owners of the company sell their shares to the public, including you and I. Companies do this to broaden their investor base, increase liquidity, and raise more capital (a fancy word for money) than would typically be accessible privately.

It also provides the opportunity where the company can raise more capital by choosing to sell more shares to the public after the IPO.

Going public doesn't come without its downsides. Once they decide to go public, companies must meet many regulatory obligations, including the obligation to disclose financial and other information to the market on a regular basis. These obligations incur material cost to the business. Additionally, the company becomes subject to public scrutiny and management must cater to the concerns of a wide range of investors.

Furthermore, every time a company issues new shares through the primary market it reduces the portion of profits attributable to the original shareholders. The size of the pie stays the same, but the number of slices in the pie goes up. This effect is called dilution.

Primary and Secondary Markets

When you trade stocks on the stock market you are trading with other investors, not the company itself.

The IPO and any secondary offerings are the only times investors buy shares directly from the company. This is called the primary market. In these cases, the money from investors goes straight to the company's balance sheet. Every other time you buy shares you are buying them from another investor. This is called the secondary market.

The secondary market is like any other market, only it is not a physical location. The trading of shares on the secondary market is facilitated by the stock exchange. Buyers and sellers submit their orders to the exchange. When the exchange receives a buy and a sell order at the same price, the exchange matches them together, the buyer receives the shares, and the seller receives the money.

You can read more about stock exchanges and the auction pricing process here.

If the company does not make or lose money from the secondary market, why should it care about its share price? Companies like to reward their shareholders for investing in them. If shareholders feel rewarded, investing in the company is more appealing and the company can potentially raise more through future secondary offerings. Additionally, managers' compensation is usually tied to the performance of the company's stock, whether through bonuses or stock-based compensation. If not for their compensation, managers want the stock to perform well because it is one of the yardsticks used to assess their competence and they could potentially be fired because of it.

Equity vs Debt

Stocks are a risky asset class (important to know if you decide to invest in them).

But stocks are not the only way to invest. Stocks are just a piece of a much larger puzzle, and it is important to understand the part that stocks play from the perspective of both businesses and investors.

Stocks are a type of equity investment. The term "equity" refers to the value of a company after all its outstanding financial obligations, such as debt, have been paid. Equity is also sometimes used as shorthand for "shareholder's equity", which is dollar value of the part of the company that is owned by shareholders.

Similar to how you or I can get a loan from the bank, companies can borrow money with the understanding that it must be paid back with interest. Unlike you or I, companies can borrow money by selling their debt to private investors in a type of security called a bond.

Debt investors, or bondholders, receive interest on the amount borrowed through fixed payments called coupons. Bonds and other debt assets are also referred to as fixed income because the investor receives a fixed interest payment as long as the issuer can afford to make its payments.

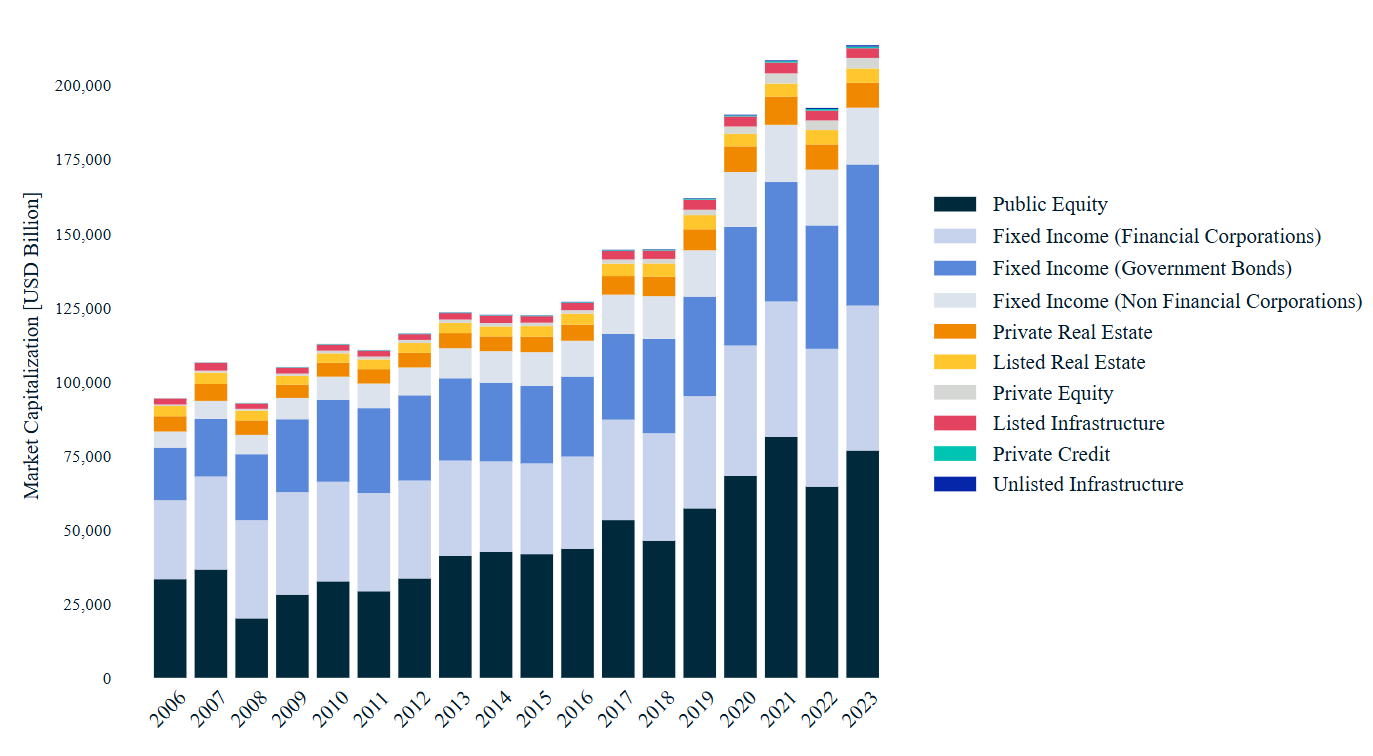

Like stocks, bonds can be traded between investors on a secondary market. For some perspective, the global bond market is actually larger than the stock market. In 2022, the global fixed income market totaled US $133 trillion compared to the equity market which totaled US $122 trillion.

For businesses, debt offers a way to raise money without diluting its shareholders. If the business has a great year and makes a lot of money, the shareholders get to keep it all (less the contracted interest payment). If the business raised the same amount of money by issuing more shares on the primary market, the original shareholders would have to split it with the new ones.

But, debt is a double-edged sword. If the business has a terrible year, it must still make those pesky interest payments. Debt is what causes businesses to go bankrupt. Therefore, the balance between debt and equity for businesses is extremely important.

For investors, bonds offer a less risky way to invest in companies. Bonds are less risky than stocks because of the fixed claim they have on the company's profits. No matter how much money the company makes, bondholders will receive the contracted interest payment (as long as the company can afford it) before the shareholders get it. But bondholders, unlike shareholders, do not benefit from an increase in the price of their bonds if the underlying business does well.

Different economic environments can favour stocks and bonds differently, and we can actually use the relative performance of the two asset classes to anticipate and measure the economic cycle.

For example, if investors anticipate an economic downturn, they may feel that the potential return for stocks does not justify the high level of associated risk. In this case, investors may move their money out of stocks and into safer assets such as bonds.

Similarly, if investors anticipate an economic expansion, the relative safety of bonds may no longer be as attractive compared to the high potential return of stocks, in which case they may move their money out of bonds and into stocks.

Summary of Key Concepts

- A stock is a financial security represents part ownership of a business.

- The value of a stock is tied to the assets and profit of the underlying company.

- When you trade stocks on the stock market you are trading with other investors, not the company itself.

- Stocks are a type of equity asset.

- Equity assets are more risky than debt assets because returns are less reliable.