Dividends & Buybacks

Dividends

A dividend is a portion of a company's profit that it decides to distribute to its shareholders. They are the most common way by which companies reward their shareholders.

Companies can choose to pay dividends as frequently as they like, but if they pay a dividend it is usually every quarter or six months.

You automatically receive dividends for the shares you own to your broker account or nominated bank account.

For many investors, dividends are the primary attraction to the stock market. This is called dividend investing, which involves investing in companies that choose to distribute large portions of their profit to shareholders. This provides a consistent stream of income to the investor, which can be used to fund their lifestyle or reinvest back into more dividend paying shares.

That sounds pretty good. Why don't we just invest in the companies that pay the highest dividends and call it a day? That's because paying a dividend comes at a cost. The money that a company distributes back to its shareholders is money that it can no longer use to invest back in its own business and fund further growth. And if its a great business, the return on money spent in this way is usually much greater than whatever the investor could receive elsewhere.

That's why companies that pay high dividends are often more mature or legacy businesses that are not perceived to have huge growth potential. On the other hand, younger companies that are focused on growth rarely pay dividends. So dividends come at the cost of capital growth or appreciation in share price.

In general, the higher the dividend yield the lower the potential for capital growth.

Your preference for dividends should be a function of your objective and time horizon. If you are in retirement and need to earn an income from your investments to support your lifestyle, then dividends are perfect. On the other hand, if you are young (like me) and wish to grow your wealth over the long-term, then dividends should not be your focus.

That doesn't mean I don't like receiving dividends, I just view them as a nice bonus. And it's great if a company can both achieve capital growth and reward shareholders through a small dividend, like Apple (AAPL) does.

Franking Credits

Dividends in Australia are particularly attractive because of a system called the imputation tax system.

Under the imputation tax system, income tax that is paid by Australian companies is treated like a "pre-payment" of tax on behalf of its shareholders. When an Australian tax-paying company pays a dividend to its shareholders, it can attach a credit, called a franking credit, equal to the amount of tax the company paid when it earned that money. Shareholders can then redeem these franking credits to offset part of their personal income tax.

You can read more about the imputation tax system here.

Dividend Rate and Dividend Yield

Dividend Yield = Dividend Rate / Share Price

The dividend rate is the amount in dollars shareholders receive per share. Dividing the annual dividend rate by the share price gives us the dividend yield, which represents the percentage return investors receive through dividends.

Companies that pay dividends tend to stick to a predictible schedule, meaning we can generally expect dividends for the amount and timing of dividends to be consistent from year to year. In the US dividends are usually paid quarterly, while in Australia they are usually paid every six months. However, companies that pay dividends can sometimes choose not to pay any dividend at all if it expects hardship, as many companies did during the Covid-19 pandemic.

For companies that do pay dividends, you should also look at how the dividend rate has changed over time. If the price of company's shares keeps rising (generally what you want when you invest), the dividend rate should rise with it. This indicates both that the business is growing and that it remains in a healthy financial position.

Payout Ratio

The payout ratio is the percentage of earnings that the company pays out in dividends.

The payout ratio provides an insight in the balance discussed above between distributing earnings and investing in growth. A 100% payout ratio means means the company is paying out all of its earnings as dividends, and indicates that management believes the money is better off being returned to investors than reinvested internally. A company like that is unlikely to grow significantly. On the other hand, a 0% payout ratio indicates that the company is not paying any dividends and is focused solely on growth.

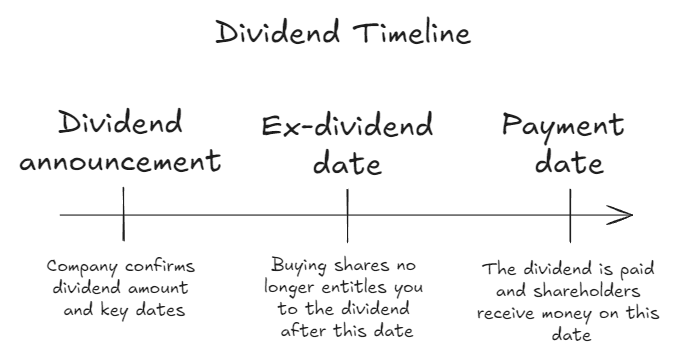

Dividend Timeline

Companies generally announce dividend payments a couple of months in advance of when they will occur. The ex-dividend date, or ex-date for short, is the cutoff to be entitled to the upcoming dividend payment. After the ex-dividend date, all shareholders and the number of shares they own are recorded. If you buy shares on or after the ex-dividend date you will not receive the dividend on the payment date. Likewise, selling your shares on or after the ex-dividend date will not disqualify you from the dividend, and you will still be paid on the payment date.

It is common for stocks to rise leading up to the ex-dividend date as demand increases from dividend investors wanting to be eligible for the upcoming dividend.

Share prices generally fall by the amount of the dividend on the ex-date.

Importantly, share prices generally fall by the amount of the dividend on the ex-dividend date. This is because owning the stock no longer entitles the holder to the dividend. The stock literally becomes less valuable by the exact dollar amount of the dividend. Thinking about it in another way, part of the company's cash balance is being paid out so the company is worth a little bit less - its intrinsic value has fallen. Normal market forces of supply and demand push the stock down accordingly.

This phenomenon is not widely explained, and can lead new investors to the misconception that dividends are free money. Yes, cash is paid straight to your bank account, but the value of your shares has dropped by exactly that amount. In other words, buying shares before the ex-dividend date does not leave you any more wealthy than if you did afterwards.

Dividend Reinvestment Plans (DRP)

Some companies offer dividend reinvestment plans, meaning shareholders can opt-in to receive additional shares in place of a cash payment. These plans are particularly popular in Australia where dividend rates are high.

The additional shares received under a DRP are free - there is no brokerage fee incurred. This allows the shareholder to easily compound the balance of their shares.

Let's look at an example. Say I have $100 of Commonwealth Bank (CBA) shares and the dividend yield of CBA is around 5.0%. Assuming the share price stays the same, I will have $105 by the end of the year - $100 in shares and $5 in my bank account. Each year my bank balance will continue growing by $5 and my shares will stay at $100. If I had instead opted to reinvest the shares, the $5 in my bank account at the end of the first year would be in shares. The next year I would receive $5.25, then $5.51 the year after that.

The calculation gets even better if the price of the shares rises over time. Each extra share received is another one that both makes your next dividend a little bit bigger and gets to benefit from the increase in price.

If you have a growth objective, meaning you don't require income and prefer to grow your money over the long-term, enrolling in a dividend reinvestment plan (if it is available) could be a good option for you.

Share Buybacks

Another way in which companies can return capital to investors is through share buybacks. A share buyback is when a company purchases its own shares on the secondary market. This process reduces the shares outstanding, which increases the value of the shares remaining since each one represents a slightly larger piece of the pie.

So where dividends reward shareholders in cash, share buybacks reward shareholders by increasing the value of the shares they own. The main advantage this is that investors do not incur any tax when the value of their shares increased. The only time tax is incurred is when the investor eventually sells the shares. This is in comparison to dividends which incur tax at the time of payment.

Reducing the shares outstanding also has the effect of boosting Earnings per Share (remember shares outstanding appears in the denominator), which can make management look good.

Companies will often do share buybacks when they have high cash reserves and its shares are viewed as undervalued, meaning it can buy back more shares than it otherwise could.

Share buybacks are Warren Buffett's preferred way of returning capital to shareholders. His company, Berkshire Hathaway, does not pay any dividends but has an extremely valuable share repurchase program.

The buyback yield is how we measure the return that a company is providing investors through share buybacks. The buyback yield is equal to the amount spent on share buybacks divided by the market capitalisation of the company. Berkshire Hathaway has averaged $3.37 billion in share buybacks per quarter since 2018. With a market cap of $977B, that gives a buyback yield of 1.38% per annum (assuming buybacks continue at the same rate).

Another company with a large share buyback program is Apple. In May 2024, Apple raised its buyback program to $110 billion, which at its current market cap represents about a 3% yield! You can see how just looking at the dividend yield, which is 0.45% for Apple, can be misleading in terms of capital return.

Summary of Key Concepts

- Businesses can return capital to shareholders through dividends or share buybacks.

- In general, the higher the dividend the lower the potential growth in the underlying business and appreciate in share price.

- The dividend yield is the amount of the company's dividend per share expressed as a percentage of the share price. Dividend yield rises when share price falls.

- The payout ratio is the portion of the company's earnings paid out as dividends.

- On the ex-dividend date, the value of the stock falls by the amount of the dividend.

- Share buybacks increase value by reducing the number of shares outstanding. We can quantify the significance of a buyback program through the buyback yield.