Exchanges & Auction Pricing

The Stock Exchange

The stock exchange is the virtual marketplace where shares are traded. For much of their history, stock exchanges were physical places you had to walk into if you wanted to trade, much like any other market. Fortunately, today everything is automated thanks to technology.

The exchange is responsible for matching the orders of buyers and sellers, as well as settling trades by ensuring buyers receive their shares and sellers receive their money. We will learn about the auction pricing process used to match orders later.

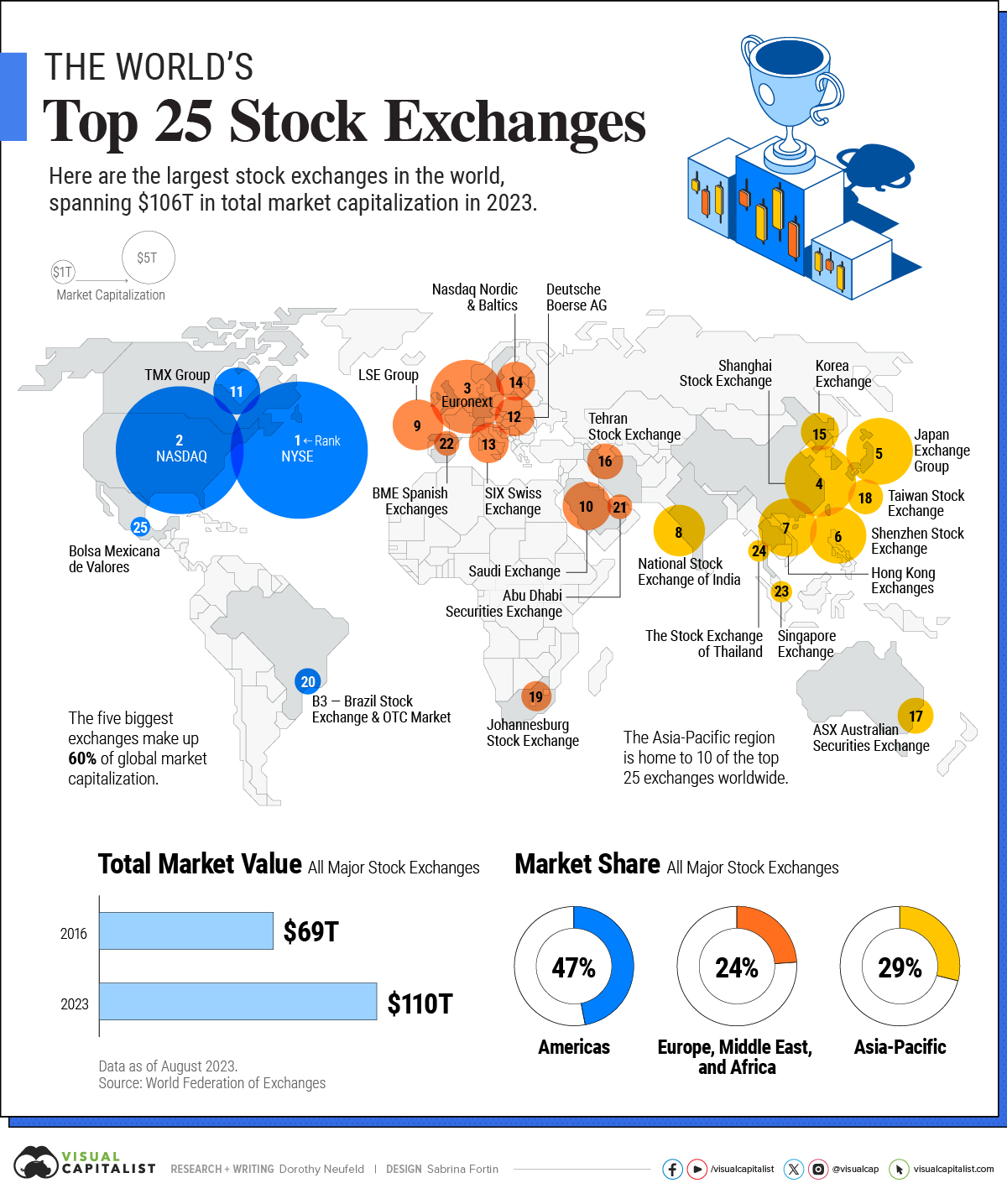

There are many different exchanges around the world. The largest is the New York Stock Exchange or NYSE, which trades the shares in all sorts of American and some international companies. Australia's exchange is the Australian Stock Exchange or ASX.

Companies will usually choose to list their shares on their country's exchange for convenience. However, sometimes they will list on larger, international exchanges if they want to provide access to investors in other regions of the world. For example, Atlassian (TEAM) is a large software company with Australian founders and headquarters in Sydney. It chose to list on the NASDAQ instead of the ASX because it is much larger and has a greater concentration of technology stocks.

The time you can trade shares is limited to the trading hours of the exchange they are listed on. For the NYSE, these are 9.30am to 4.00pm ET, Monday to Friday. For the ASX, these are 10.00am to 4.00pm AEST, Monday to Friday. Exchanges will often observe national public holidays as well.

Outside of trading hours is when the stock exchange calculates the opening price for every stock. If the exchange receives a large number of orders for a stock between sessions its price will rise or fall accordingly. This can often happen when companies make a significant announcement outside trading hours. It can be frustrating to watch the price of stocks you want to buy or sell move without being able to do anything about it, but unfortunately that's just the way it is.

Stock Brokers

To access the stock market you need a stock broker. Brokers submit buy and sell orders to the exchange on your behalf.

Before the internet, stock brokers were all real people who had to phone the exchange or physically go there on your behalf. Today, full-service brokers like these typically only service high net-worth individuals and institutions. These brokers will also provide advice on everything from which stocks to buy to portfolio management. This advice is expensive, but can be extremely valuable in guiding you through the ups and downs of the market.

The other type of broker is called a discount, or execution-only, broker. These brokers are electronic and simply execute the orders you give them. They are much cheaper than a traditional broker.

You will incur a brokerage fee every time you buy and sell a stock.

Recently, some online brokers like Robinhood have started offering commission-free trading (unfortunately Robinhood is not available in Australia). Other than these special cases, brokers typically charge a commission every time you transact.

For discount brokers, the typical commission can be anywhere from $5 to $20. In comparison, full-service brokers charge anywhere $100 up to 1% of the value of the transaction.

The brokerage fee applies both when you buy and sell a stock. That means it will apply at least two times per investment. This cost is not insignificant, especially if you are not starting out with a lot, and will impact how much money you make. For this reason, your choice of broker is an important consideration on your investing journey. To help you out, here's a list of the top online brokers in Australia.

Auction Pricing Process

Stock exchanges facilitate the trading of stocks through an ongoing auction process, similar to the auction process you are probably familiar with for real estate except that sellers are also participants. Buyers and sellers submit their orders, consisting of a price and quantity, to the exchange via a broker. When the exchange receives a buy and sell order that overlap, the exchange matches them together and the shares change ownership from the seller to the buyer.

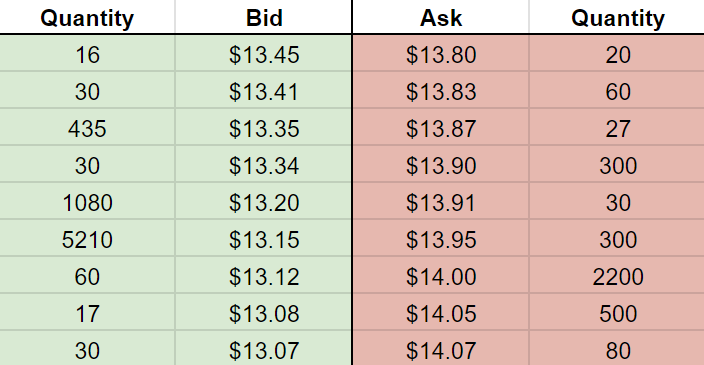

All of the buy and sell orders are arranged into an order book, like the one below. The buy orders appear in descending order on the left and the sell orders ascending on the right. Order books are publically available for every stock, but often you have to pay your broker or a data provider to access them.

There are a couple of notions of price that are important to distinguish between. The price that is referred to most is called the last price and is the price at which the matching process described above last occurred. This is what you get when you look up a stock in the Stocks app on your iPhone or in Google. However, it is not guaranteed that you can actually buy or sell shares at this price. Buying shares requires there to be a seller willing to give them to you at the price you want, which is not always the case.

The bid price is the highest price that buyers are willing to pay for the stock. In the above order book the bid price is $13.45. If you wished to sell your shares immediately, this would be the price you receive (assuming there are enough shares available), not the last price. Conversely, the ask price is the lowest price that sellers are willing to give shares away for. In the above order book the ask price is $13.80 and this is the price you would pay if you wanted to buy shares right now.

I used to always get confused between the bid and ask price. To remind yourself which is which, remember that it is just like any other auction. For example, in a home auction the buyers place bids. The price the owners want to sell the house for is the ask, and the price that the house last sold for is the last price.

For a stock to move up (down), all of the sell (buy) orders above (below) it must be filled.

For a stock to increase in price, all the sell orders have to be filled up to that price. In the example above, to get to $14.00 all of the orders on the LHS up to $14.00 must be filled. In other words, someone has to buy 20 shares at $13.80, 60 shares at $13.83, and so on. You can see that there are significantly more shares 2200 on offer at $14.00. This is referred to as a sell wall and can act as a barrier that limits the price from increasing.

Different Types of Orders

A limit order executes at the price you specify (or better), while a market order executes at the current bid or ask price.

The type of order that consists of a price and quantity is called a limit order. The exchange executes a limit order if there is an opposing order that overlaps in price. If I submit a buy order with a limit price of $10 and there is an existing sell order with a price of $9.98, our orders will match and I will receive the shares for $9.98.

Limit orders are great for getting an accurate price for your shares. However, they come with the risk of not being executed at all if your limit is never met.

If you simply want to buy or sell shares as soon as possible you can submit a market order. When you submit a market order to your broker, it will simply be added to the market at the best available price from the opposing side. In the above example where there is an existing sell order at $9.98, I can just submit a market order and I will automatically be matched at this price (assuming this is the lowest available price).

The disadvantage of a market order is that you could get a price that is different to what you had in mind. This can happen when stocks are active and price is moving quickly. I might look at my Stocks app and see the price is $10, but after the 60 seconds it takes me to open my broker account and fill out my order there are no more shares available at that price. If I submit my market order I will get the next best price which could be anywhere from $10.01, to $10.05 or higher.

This issue also presents itself when you submit an order after market hours. If something happens before the market opens that causes the stock to move significantly, you could end up buying it for 5%, 10%, or 20% more than you intended.

Most stocks have high liquidity, meaning there is usually a high enough quantity of shares at the bid and ask prices for your order to be filled by an opposing one straight away. However, in some cases your order can be partially filled meaning you only get some of the shares you want.

This can be a bit tricky to wrap your ahead around. But there's better way to learn than by doing. Try submitting different types of orders for yourself using the simulator below.

Order Book Simulator

| Quantity | Bid | Ask | Quantity |

|---|

Knowing when to use each type of order is important. You should use a limit order when you have a price in mind. However, if your price is not significantly different to the market price, you might be better off with a market order just to ensure your order is filled.

Summary of Key Concepts

- You will incur a brokerage fee every time you buy and sell a stock.

- Shares are traded via the auction pricing process.

- The bid price is the highest price at which someone is willing to buy a stock, while the ask price is the lowest someone is willing to sell it.

- For a stock to move up or down, all of the sell or buy orders must be filled up to that price.

- A limit order executes at the price you specify (or better), while a market order executes at the current bid or ask price.