Market Indexes

Market Indexes

A market index is a hypothetical portfolio of assets that is used to track the performance of a particular sector or area of the market. They are used as a common way to measure the performance of investors' portfolios, and are perhaps the most significant and widely quoted metrics in finance.

You may have heard financial commentators say "the market went up" or "the market went down". They are generally referring to a market index.

The hypothetical part is important. An index is like a shopping list, containing the items and the number to buy. Actually going and buying all the items on the list is another matter. Buying all the stocks on the list to make a real portfolio you can invest in is the job of exchange-traded funds (ETFs).

Because you can't directly buy an index, indexes are measured in points (not price).

Types of Indexes

Indexes can be broad, covering stocks from various areas of the economy, or narrow, focusing on specific sectors, countries, or themes.

An example of a broad index is the MSCI World Index, which includes over 1,000 stocks from countries all over the world.

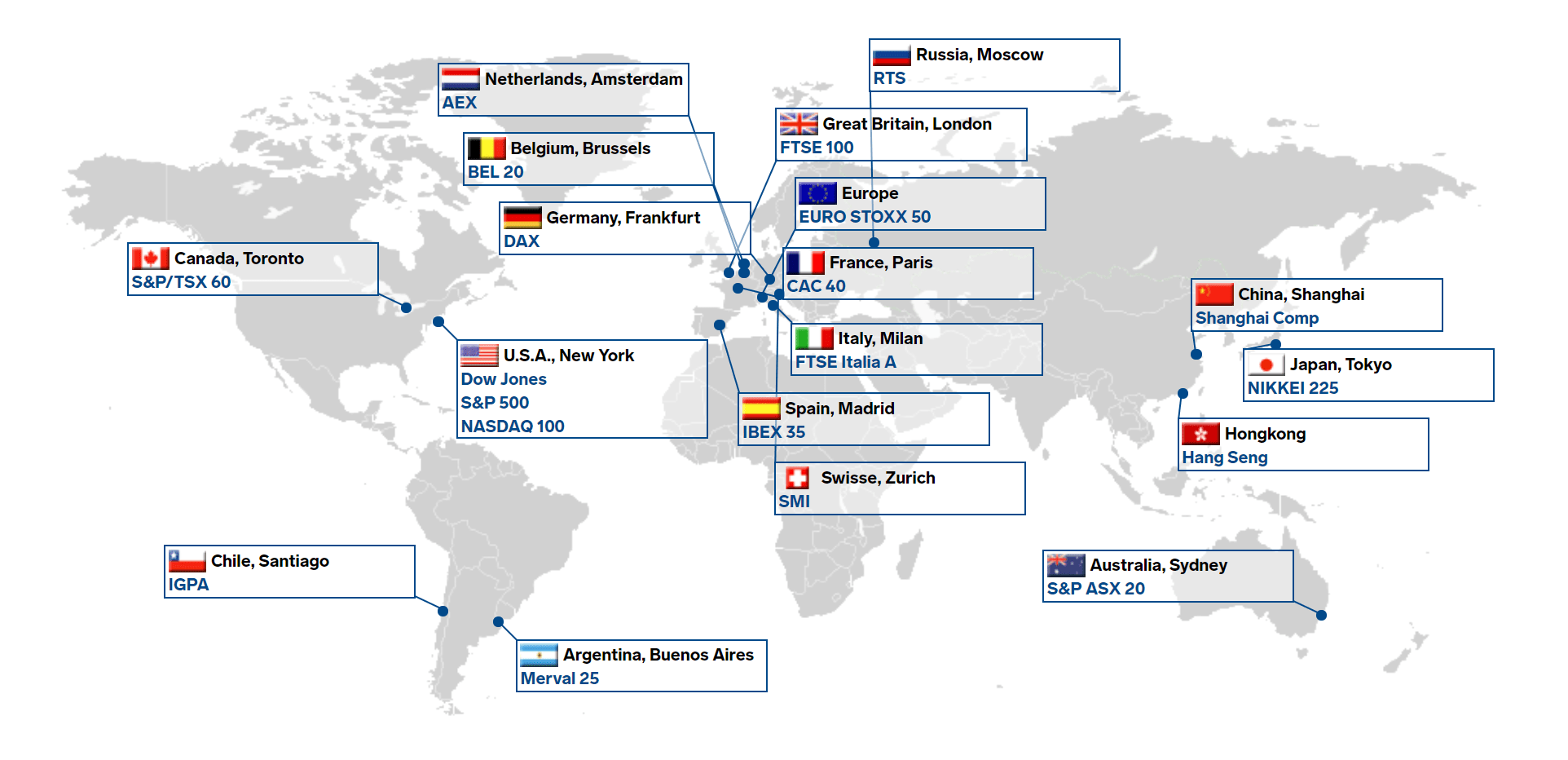

Most major exchanges around the world have a corresponding index for measuring the performance of their stocks. For example, the S&P/ASX 200 Index tracks the performance of the top 200 ASX-listed stocks.

Stock market indexes are commonly market-cap weighted, which means the weight of each stock in the portfolio, or the number of shares on the metaphorical shopping list, corresponds to its market capitalisation.

The S&P 500 Index, maintained by S&P Global, is perhaps the most widely used market indexes. It is a hypothetical portfolio that includes every available share of the 500 largest companies listed in the US. It is also market-cap weighted. At the time of writing, Apple (AAPL) is the largest company in the US and therefore has the largest weighting in the Index at 6.86%.

Other common indexes are include:

- Dow Jones Industrial Average (DJIA) - one of the oldest indexes that exists and includes only 30, large "blue-chip" US stocks.

- NASDAQ Composite - includes all stocks listed on the NASDAQ exchange, which has a heavy technology/innovation focus.

- Russell 2000 - includes 2,000 smaller US companies and is commonly used as a benchmark for small-cap stocks.

Indexes as Benchmarks

Market indexes provide a benchmark for investors to measure the performance of their portfolios against.

The benchmark you choose to asses your performance against depends on the type of portfolio you have. If your portfolio contains mostly ASX-listed stocks, it is unfair to assess your performance against the S&P 500 Index because Australian and US companies operate in different economies and have very different risk and return profiles. This would be like comparing apples to oranges. You should instead compare apples to apples by using the ASX 200 as your benchmark.

If your portfolio goes up by 20% in a year you'd likely be over the moon. But if the rest of the market went up 30% in the same time, you essentially missed out on 10%. All that time and effort you spent picking which stocks to buy and when to buy them netted you -10% in relative performance. With the help of Exchange-Traded Funds, you could have instead bought a portfolio that mirrors the S&P 500 and been 10% better off.

The same applies in reverse. If your portfolio goes down 10% in a year, you might be pretty distraught. But if the rest of the market fell 20% you actually did quite well. We say you outperformed by 10%.

This is what it means to beat the market.

Whenever you buy a stock, your objective is not just for the stock to go up. It's for the stock to go up by more than the comparible benchmark over the same time.

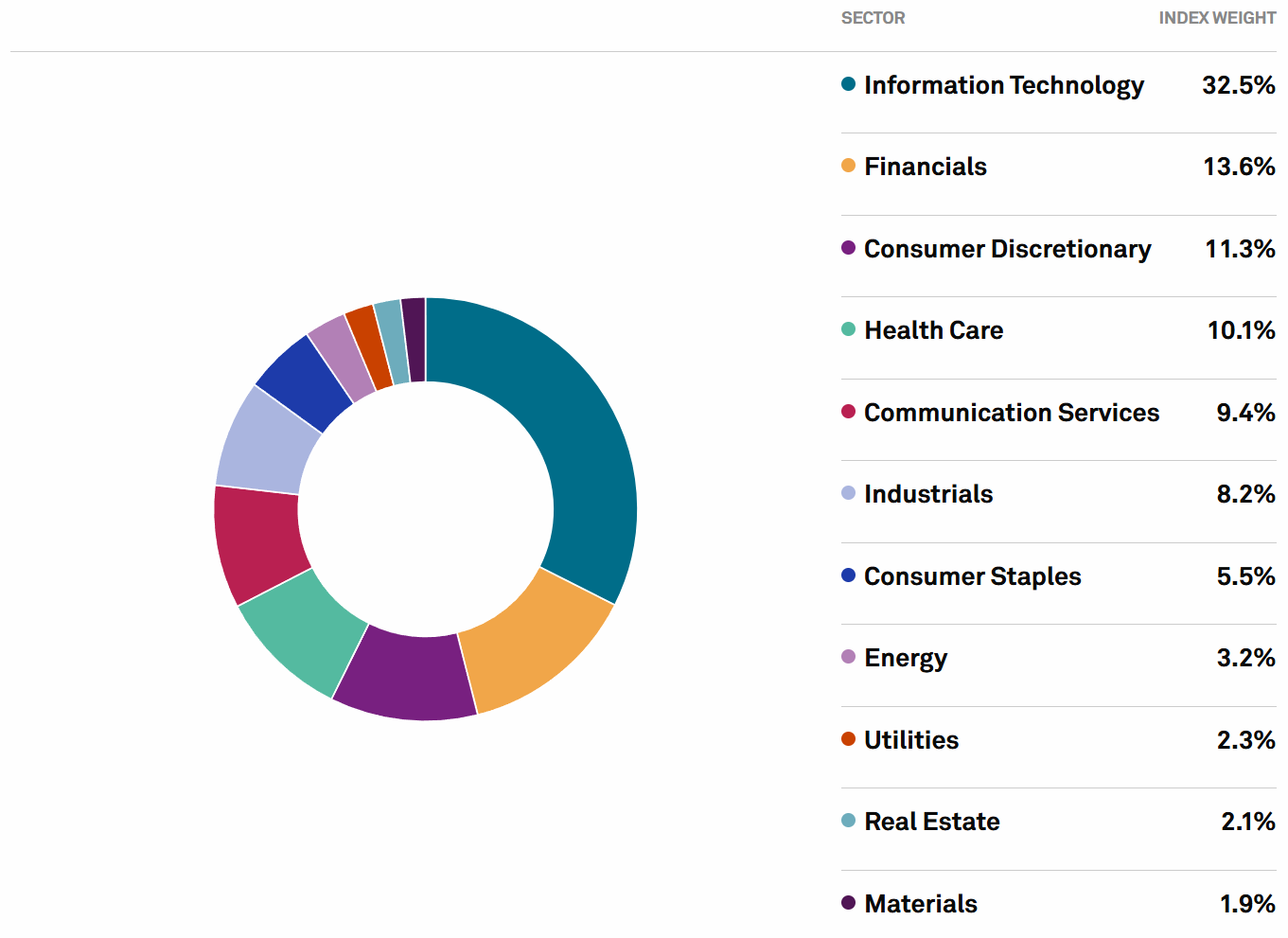

The S&P 500 Index

There is a reason the S&P 500 is one of the most common benchmarks. The US is the largest economy in the whole by GDP and many big US businesses operate internationally. Other global economies tend to be correlated with it. The hypothetical portfolio is so large that its value is roughly 80% of that of all publicly traded US stocks. The index is also well-diversified and has a balanced exposure to each of the market sectors. In comparison, the ASX 200 Index is heavily skewed towards the mining and financials sectors simply due to the nature of the Australian economy.

Collective Wisdom

Because the S&P 500 is so large and globally relevant, it can be viewed as a proxy for the collective wisdom of every single investor from around the world. The Index is approximately what you get when you add up the portfolios of every single investor in US stocks, from mum and dad investors to professional fund managers.

Apple is the largest company by market capitalisation because investors collectively believe it is. If something happens to Apple that investors perceive is negative, it's share price will drop and it will no longer be weighted as highly in the hypothetical portfolio. The metaphorical shopping list will not contain as many Apples (pun intended). Conversely, if collective wisdom perceives something to be positive about another stock, its value will rise and the hypothetical portfolio will include more of it.

Collective wisdom is powerful. The S&P 500 Index has returned an average of 10% p.a. historically, a return most investors would be happy with and one that many struggle to replicate themselves. And with ETFs, buying a mini version of the S&P 500 Index and enjoying these returns is incredibly easy.

Betting on collective wisdom by buying an index fund is an incredibly sensible decision. In fact, beating collective wisdom is so hard that the advice that the richest investor of all time, Warren Buffett, gives to new investors is to simply buy an S&P 500 Index fund and call it a day.

Summary of Key Concepts

- Market indexes are hypothetical portfolios that track the performance of a particular sector or area of the market.

- Indexes are like shopping lists which detail the stocks and number of shares to buy.

- Most major exchanges around the world have a corresponding index for measuring the performance of their stocks.

- It is good practice to compare the performance of your portfolio to an appropriate market index, like the S&P 500 or ASX 200.

- The S&P 500 Index is one of the broadest and most commonly used indexes. It is viewed as a proxy for investors' collective wisdom.