Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs)

Exchange-traded funds or ETFs are a popular way of investing in stocks that require minimal time and effort on the investor's behalf. To understand ETFs, imagine the following scenario.

Imagine you are at the market and need to buy fruit for a fruit salad, but you have never made a fruit salad before and have no experience buying fruit. You don't know which fruit to buy for your salad, let alone how to determine the quality of fruit from each stall to ensure you only select the best. Then, you stumble accross a stall that sells entire baskets containing different types fruit. The shop owner specialises in this sort of thing and has selected the best fruit for you, saving you the time and effort required to select the fruit yourself.

Now imagine you really want to invest in stocks, but you don't know how to select the ones that will make you the most money. There are thousands of stocks to choose from. Well, just like the fruit, you can buy the whole basket with an ETF.

ETFs are investment funds that hold a group of underlying assets and can be bought and sold on exchanges just like individual stocks.

The advantage of having a group of underlying assets in a single investment is diversification. If one the assets performs poorly, you still have exposure to numerous other assets which (hopefully) perform a bit better so that your overall position is not significantly impacted.

Active vs. Passive ETFs

ETFs can be passively managed, in which case the objective is to simply approximate the performance of an index. Recall that indexes are really large, hypothetical portfolios. It is the fund manager's job to go and actually buy the stocks and construct a portfolio with the same weights as the hypothetical one. The SPDR S&P 500 ETF (SPY) is a passive ETF that mirrors the performance of the S&P 500 Index. When S&P Global updates the Index, managers of this ETF must buy and sell the actual shares to keep the mini portfolio in line with the hypothetical one.

Indexes and ETFs can be broad or focused on a particular sector or investment theme. For example, the iShares Russell 1000 Growth ETF (IWF) is a passive ETF that tracks the performance of the - you guessed it - Russell 1000 Growth Index. This index contains stocks that exhibit growth qualities, which could be a better option for investors with a capital growth objective and a long time horizon.

ETFs can also be actively managed, in which case professional investment managers will attempt to outperform, not approximate, a benchmark by actively buying and selling stocks. The L1 Capital Long Short Fund ETF is actively managed by L1 Capital with the simple objective of outperforming the ASX 200 Index.

Actively managed ETFs can also have a narrow focus on a particular sector or investment theme, like the Global X Artificial Intelligence ETF (GXAI) which focuses on stocks expected to benefit from AI.

The other advantage of ETFs is their cost. Every time you buy and sell individual stocks you incur a brokerage fee. With an ETF, brokerage is only charged once to invest in anywhere from 100 to 1,000 underlying stocks. Instead, a small management fee is charged (the management for the SPY ETF is 0.09%) and is simply deducted from the fund.

ETFs vs Stocks

ETFs are a highly sensible investment alternative to individual stocks. Whatever your objective, there is most likely an ETF that does exactly what you need. Therefore, the choice to invest in individual stocks, with the additional cost, time, and effort required, must be weighed against whether you would be better off simply buying an ETF.

If I wanted to invest $1,000, I could spend time trying to select individual stocks that I expect to make the most money and constantly managing my portfolio thereafter. Or I could buy one actively managed ETF for $1,000, pay only one brokerage fee, and let a professional manage the portfolio for me.

If ETFs are that good, why even try to invest in individual stocks? The advice that the richest investor of all time, Warren Buffett, gives to new investors is to simply buy an S&P 500 Index fund. If a passive and hands-off approach to investing appeals to you, then ETFs are simply your best choice.

If you want something done right, do it yourself. - Napoléon Bonaparte

Investing in individual stocks provides flexibility and opportunity. While ETFs do protect you from potential loss through diversification, they also restrict your potential upside.

If you have a particular edge that sets you apart, you have no way of expressing it by investing in ETFs.

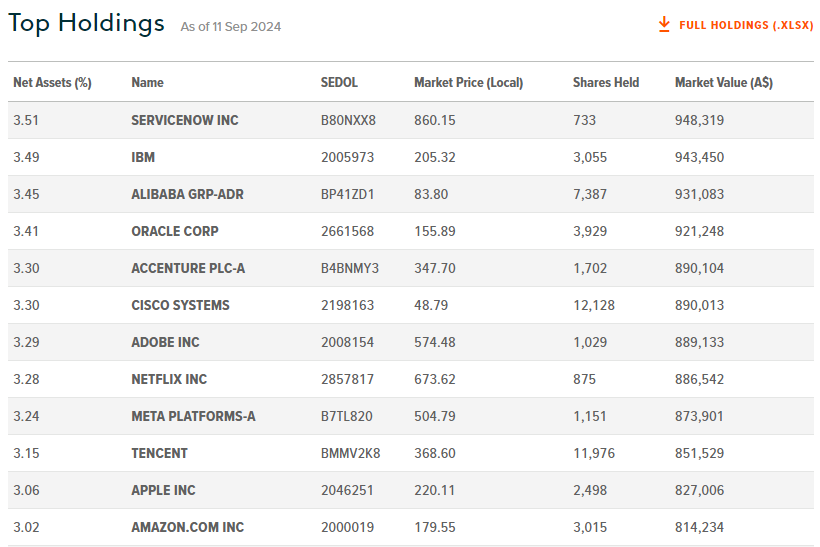

Once we know how to analyse stocks, we can start to specify the exact characteristics or traits of the ones we want to invest in. For example, out of the top holdings of the GXAI ETF above, maybe we don't want to be invested in Alibaba (BABA), Oracle (ORCL), or Cisco (CSCO). Maybe we know that Meta (META) or Amazon (AMZN) are leaders in AI technology and we want to invest a larger portion of our money in those. Nvidia (NVDA), which is arguably one of the biggest beneficiaries of AI, is not even in the top 10 holdings above.

That being said, there are still situations where I would recommend ETFs for active investors. In cases where you decide you want to invest in a particular sector or theme that is outside your circle of competence (e.g. I would consider the resources and pharmaceuticals sectors to be outside my circle of competence), you can buy an ETF to gain exposure while letting a professional manager look after it for you.

Summary of Key Concepts

- ETFs are investment funds that hold a group of underlying assets and can be bought and sold on exchanges just like individual stocks.

- ETFs provide a cheap investment alternative to individual stocks that involve much less time and effort on behalf of the investor.

- ETFs can be used to invest in themes or sectors that are outside your circle of competence.