Researching ETFs

How to Research ETFs

Exchange-traded funds (ETFs) are a highly sensible investment for most investors. ETFs remove a lot of the time and effort involved in managing a portfolio, while still providing reasonable and consistent returns.

Whether an active or passive ETF, once you buy an ETF it is the fund manager's job to buy and sell shares in the underlying portfolio in order to meet the fund's objective.

That's great, but there are so many ETFs out there. Each ETF is designed to fulfill a specific role in investor's portfolios, so selecting the right ones can be overwhelming.

Target Market Determination (TMD)

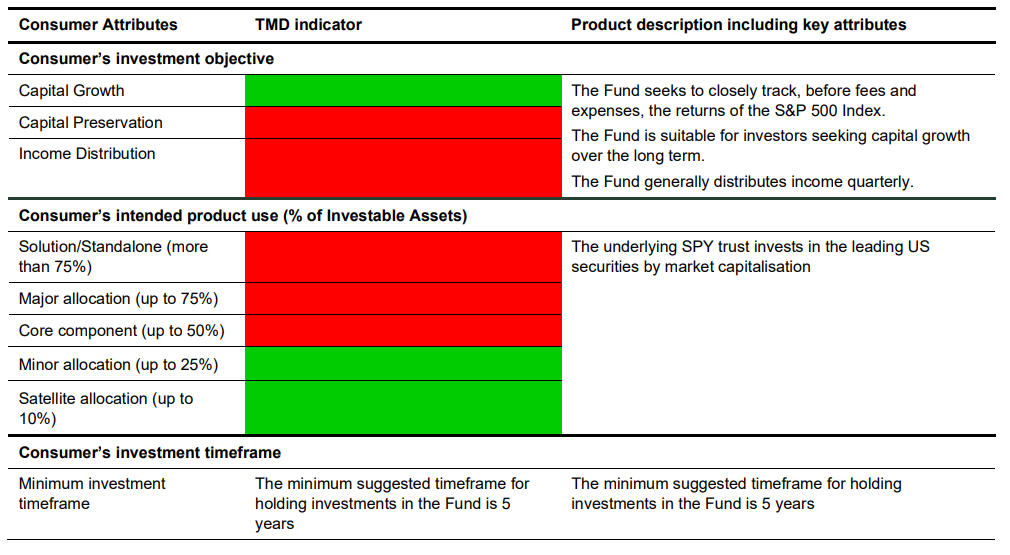

To help investors select ETFs, investment funds in Australia are required to provide a Target Market Determination (TMD). A Target Market Determination is a regulatory document that outlines the type of investor that the ETF is intended for.

The Target Market Determination breaks down the suitability of an investment in an ETF by investor objectives, risk tolerance, time horizon, and even the intended portion of the investor's net worth that will be allocated to it.

This makes it very easy for investors to decide whether an ETF is appropriate for them. All you have to do is open up the Target Market Determination and see whether you fall inside the target market.

Product Disclosure Statements (PDS)

The Product Disclosure Statement (PDS) is another regulatory document that provides essential information about ETFs.

The Product Disclosure Statement provides details such as the fund's investment objective, asset structure, fees, and, if it's active, the investment strategy or methodology of the portfolio managers.

Together with the TMD, these two documents are designed to provide investors with all the information necessary to make an informed investment decision.

Investment Objective

Every investment fund has an objective. An objective defines the purpose a fund and determines the types of stocks it will own and its overall investment strategy.

A fund's objective also determines the type of returns you can expect from investing in it.

Common objectives include simply matching the performance of a selected index (as is the case for passive ETFs), outperforming a selected index, or consistently providing a target annualised return throughout the economic cycle.

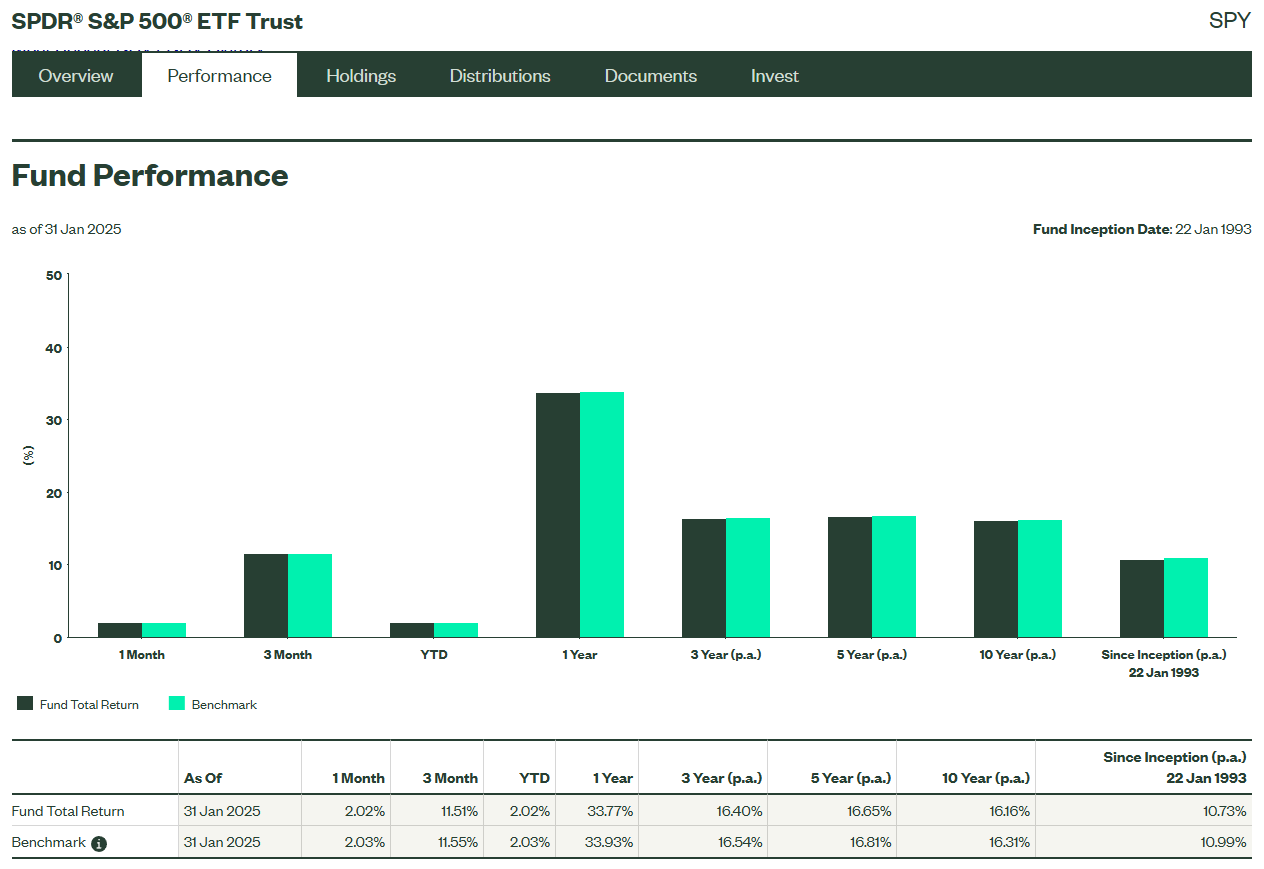

For example, the objective of the SPDR S&P 500 ETF (SPY), a passive ETF, is to "provide investment results that, before expenses, that correspond generally to the price and yield of the S&P 500 Index".

Anticipating the performance of this ETF is easy. We know that the S&P 500 Index has returned an average of 10% p.a. since 1957, so we can roughly expect the ETF to do the same.

From the fund's objective we can also anticipate the level of risk associated with its returns. The S&P 500 has had large drawdowns since 1957, such as during the Global Financial Crisis and the Covid-19 pandemic. Because it is passive, the managers of the ETF won't step in to save investors if another large drawdown occurs. Therefore, investing in the SPDR S&P 500 ETF requires a moderately high risk tolerance and long time horizon.

In comparison, the objective of the Munro Global Growth Fund Complex ETF (MAET), an active ETF, is to "provide investors with meaningful, risk-adjusted, absolute returns through exposure to global growth equities".

From this objective we can tell that the fund likely won't be investing in Commonwealth Bank (CBA) or Woolworths (WOW). This tells us that we can expect the fund to have both a higher level of risk and average return than the S&P 500 over the long-term.

When comparing the performance of different ETFs, it is important to consider their objectives. It would be unfair to directly compare the performance of the SPY and MAET ETFs because they are designed to fulfill different roles. This would be like comparing apples to oranges.

Always consider the underlying fund's investment objective when comparing two ETFs.

Benchmark

So how can you tell whether a fund is achieving its objective?

Markets move in great big cycles. Sometimes particular sectors or themes can experience a significant burst of growth, only to underperform for an extended period of time thereafter. This means that our expectations for return should not always be the same (e.g. I wouldn't expect an ETF to return 10% p.a. every single year into perpetuity).

A benchmark is a way for investors and portfolio managers to measure the performance of a fund throughout these natural market cycles. The benchmark is chosen by the fund manager, and provides a common and objective measuring stick that everyone can use to determine whether the fund is achieving its objective, regardless of market conditions.

A benchmark is usually in the form of a market index. A benchmark can be broad like the S&P 500 or the ASX 200, or, if the fund has a focus on a specific sector or theme, narrow like the Russell 1000 Technology Index or the ROBO Global® Robotics and Automation Index.

Investment funds usually quote their historical performance in comparison to the selected benchmark for investors to easily assess performance.

Benchmarks are particularly important for active ETFs. If an active ETF has a particularly bad year, it may not be the fault of the manager. Likewise, a particularly good year may not be attributable to the manager. Comparing the fund to its benchmark is a way of determining whether the fund's performance is a result of the manager's expertise, or of natural fluctuations in the market. You want to see that the fund has outperformed the benchmark, not just for one or two years, but consistently over the long term.

For passive ETFs, it is expected that the fund's performance will be very close to the benchmark.

Holdings & Allocation

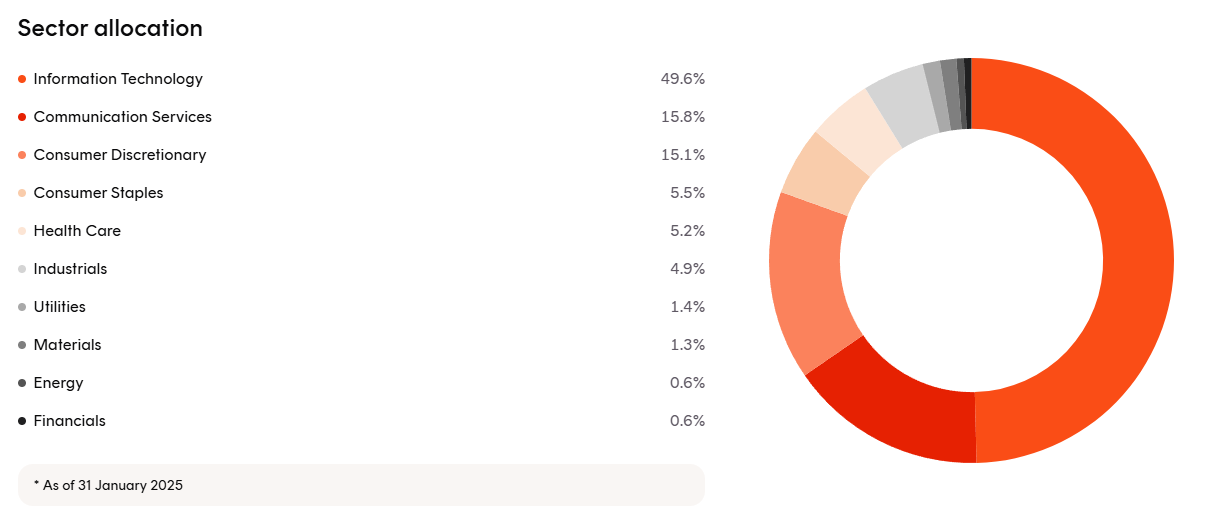

When you buy an ETF, you get to own a small amount of a wide range of stocks of the underlying portfolio. It is important to consider how the allocation of stocks within the ETF will impact the diversification of your overall portfolio.

You can usually find details about the sector allocation and top holdings for passive ETFs in a document called the Fact Sheet. Active ETFs may be a bit more secretive about these details because their allocation to sectors or individual stocks is part of their competitive advantage.

You generally want to buy ETFs that provide attractive potential return with minimal overlap with your existing portfolio.

For example, the Betashares Nasdaq 100 ETF (NDQ), a passive ETF that tracks the Nasdaq 100 Index, has nearly a 50% weighting to the technology sector. Taking a closer look, we can see that the ETF's largest holding is Apple (AAPL) with a weighting of almost 10%.

If you have a high risk tolerance and minimal existing allocation to the technology sector, this ETF is a great option.

However, if you you already have a high allocation to the technology sector or Apple stock, buying this ETF may simply increase your risk without adding to your potential return. If something bad happens to the technology sector this ETF will fall along with the rest of your portfolio. And if something good happens to the technology sector it will rise along with the rest of your portfolio. In either case, the return of your overall portfolio is not significantly changed by the inclusion of this ETF.

Expense Ratio

ETF managers don't work for free. Just like you and I pay brokerage, ETF managers incur transaction fees whenever they make changes to the underlying portfolio. There are also administrative and regulatory fees, and, if the fund is actively managed, salaries for the portfolio managers that have to be paid.

The expense ratio is a measure of the annual fee that the ETF manager charges as a percentage of your investment in the fund.

If you invest $100 in an ETF with an expense ratio of 1%, you will pay $1 in fees over the course of one year.

Don't worry, the fee that you pay does not come out of your bank account. The fee is taken out of the fund's assets and simply reduces the return to investors. If the value of the above fund's assets rises by 5% during the year, your initial investment would go from $100 to $104 ($105 less the $1 fee).

The management fee is like the rake in a poker game. After each hand, the dealer discretely takes a small percentage of the chips from the pot before giving the remainder to the winner. It's hard to notice any difference in the amount of chips on the table, especially if you're a winner and your stack of chips keeps going up. It's easier to notice if your chips keep going down.

Part of the attraction of passively managed funds is their low expense ratio. All that the managers of these funds have to do is to match the performance of the corresponding benchmark.

For example, the expense ratio of the SPDR S&P 500 ETF (SPY) is only 0.0945%.

On the other hand, the expense ratio of the Magellan High Conviction Trust (MHHT), an actively managed ETF, is 1.50%.

This fee may be justified, if the active management of the fund produces excess returns sufficient to cover the expense. In this case, at the time of writing the Magellan High Conviction Trust ETF (MHHT) has returned 8.51% p.a. over the last five years versus the SPDR S&P 500 ETF (SPY) which has returned 16.81% p.a. over the same time. In other words, Magellan has underperformed SPY by over 8% and charged 1.50% to do so.

On face level this might be pretty discouraging. However, we have to make sure we're not comparing apples to oranges. The Magellan fund's objective is to "achieve attractive risk-adjusted returns over the medium to long-term", while SPY's is simply to match the S&P 500 Index. If all you are looking for is attractive risk-adjusted returns over the medium to long-term perhaps MHHT's management fee is justified after all (determining what "attractive" means is a different and more subjective matter altogether).

Summary of Key Concepts

- Every ETF must provide a Target Market Determination (TMD). You can use this to determine whether an ETF is right for you.

- Benchmarks provide a way to measure a fund's performance and determine whether it is achieving its objective, regardless of market conditions.

- Always consider the underlying fund's investment objective when comparing two ETFs.

- Always consider the underlying fund's top holdings and sector allocation to avoid overlap with the other holdings in your portfolio.

- Every ETF charge a management fee. If all else is equal, choose the ETF with the lower fee.