Diversification

Diversification

Don't put all your eggs in one basket. - common investment advice

One of the most commonly repeated pieces of investment advice, and one you've probably heard before, is "don't put all your eggs in one basket." Whether it's your parents, grandparents, or financial gurus, everyone seems to go on about diversification. They make it seem like diversification is the be-all end-all of investing, and to not diversify is to commit financial suicide.

Diversification is the act of reducing risk by purchasing shares across a variety of companies, industries, and sectors.

Investing in stocks exposes you to the risk of losing money. Risk exists because of the uncertainty about knowing what will happen in the future. No matter how sound your investment thesis is, there is always a risk that the future does not play out as you expected. Whether it's a global pandemic or financial crisis, unexpected things happen all the time.

Diversification protects your portfolio against uncertainty by limiting the reliance of your returns on any one stock or sector. The idea is that if something bad happens to one of your stocks, the other stocks in your portfolio will not be affected and therefore your portfolio will not perform as badly as if you only owned that one stock. To use the egg analogy, if something happens to one of your baskets that causes the eggs to break, you wouldn't be ruined because you would still have eggs from the other baskets.

Systematic and Unsystematic Risk

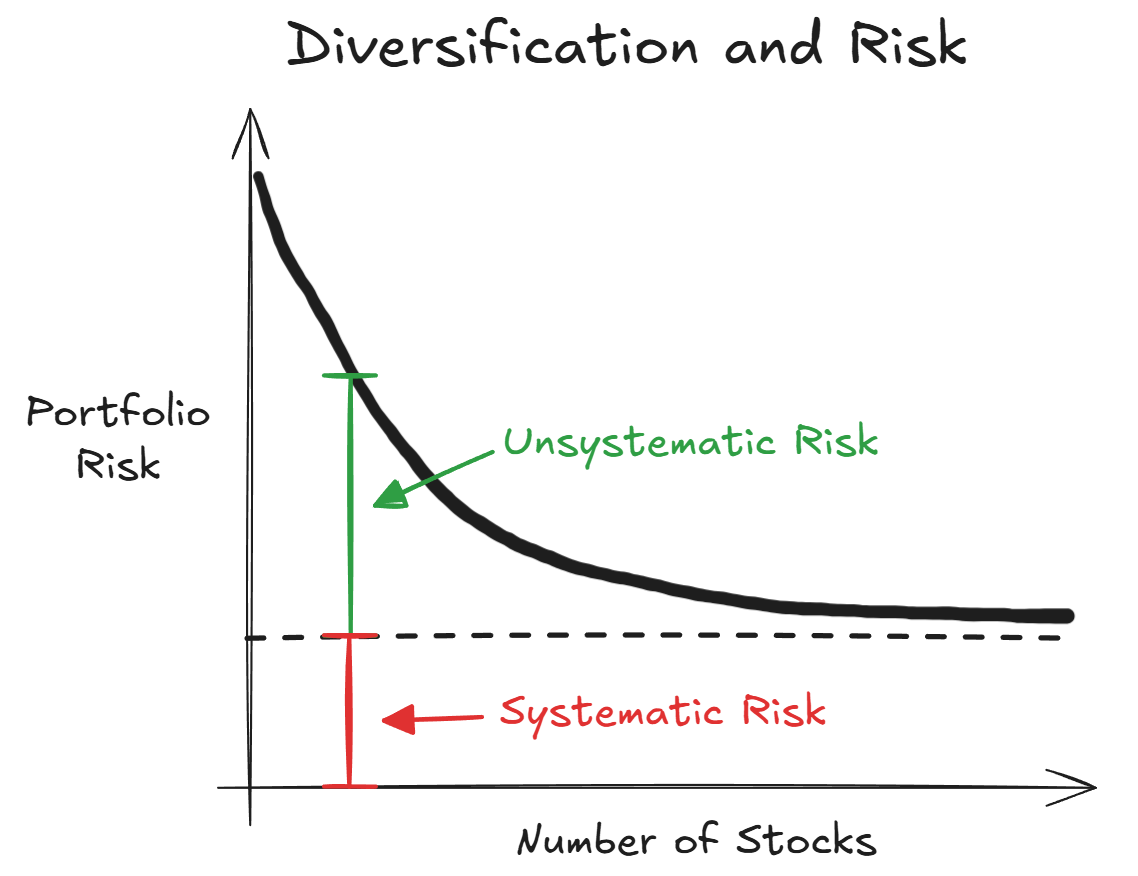

Systematic risk is the risk arising from macroeconomic and other factors that effect the entire market. For example, a global pandemic represents a systematic risk to the market and would generally have a negative impact on stocks in every sector. On the other hand, unsystematic risk is the risk arising from fundamental factors that only effect the one company or industry. For example, changing consumer preferences, supply chain disruptions, regulatory changes, and management inefficiency are unsystematic risks that can effect individual companies.

Diversification through exposure to a variety of stocks or sectors reduces unsystematic risk, because when one company or sector performs badly, the portfolio as a whole is not impacted as severely.

Diversification cannot eliminate systematic risk. Because systematic risk applies to every stock equally, it cannot be eliminated from your portfolio by simply adding more stocks and more stocks. For this reason, systematic risk is also called undiversifiable or market risk. Again with the egg analogy, it's like if some universal disaster (maybe an earthquake or cyclone) causes all the eggs in all of your baskets to break.

Examples of systematic risk include the Global Financial Crisis of 2008 and the COVID-19 pandemic in 2020. In either case, it's likely that every stock on the market was impacted and no amount of diversification would have protected your portfolio against the downside.

The relationship between systematic and unsystematic risk can be visualised by plotting the risk versus the number of stocks in a portfolio (below). The result is a downward-sloping line that flattens out as it approaches some minimum level that it cannot cross below. That level is systematic risk.

Correlation

The key to diversification is selecting stocks that are uncorrelated with each other.

Correlation in the stock market is a measure of how different stocks move in relation to each other. Stocks with a high correlation tend to move in the same direction. If one of them goes up, it is more likely than not that the other will go up as well.

An example of two highly correlated stocks is Coles (COL) and Woolworths (WOW). These are both supermarkets of similar size that operate in the Australian market, so it is likely that anything that affects one will also affect the other. The effect of buying both Coles and Woolworths is statistically very similar to buying either one on its own and does little to improve the risk-return profile of your portfolio (you also pay a brokerage fee for each transaction, so you should probably just pick one and roll with it).

On the other hand, stocks with a low correlation tend to move independently from each other. The movement of one stock has no statistical impact on the likelihood that the other will go up as well.

An example of two uncorrelated stocks is Coles (COL) and Apple (AAPL). Each operates completely different businesses and in different markets.

Stocks can also be negatively correlated, in which case each stock tends to move in the opposite direction of the other. However, negative correlation in stocks is rare. There are usually at least a few factors that two businesses will have in common that will drive their respective returns (think about inflation, interest rates, consumer spending).

To maximise diversification, you should buy stocks with a low or negative correlation.

Diversification Simulator

Use the simulator below to see how adding stocks to your portfolio affects the volatility of returns. Stocks have 10% of being a "loser" which has terrible returns and a 20% of being a "winner" which has great returns. You should be able to see how adding stocks to your portfolio protects against the negative effect of "losers" but also limits the positive effect of "winners".

Disadvantages of Diversification

The principle of risk and reward says that potential return is proportional to risk. That principle applies here as well. Diversification doesn't just limit your downside, it also limits your potential upside.

If one of your stocks significantly outperforms, your return won't be as high if you spread your money across a number of other stocks than if you had concentrated your money into the outperformer.

Additionally, because you can never eliminate systematic risk, the benefits of diversification are diminishing with the number of stocks you add to your portfolio. Therefore, there comes a point where adding more stocks to your portfolio could be a bad thing.

Diversification is protection against ignorance. It makes little sense if you know what you are doing. - Warren Buffett

If you know what you are doing, diversification is like stabbing yourself in the foot. If your circle of competence is in one particular sector of the market, your returns are likely to be better inside that particular sector. In situations like this, venturing into other sectors of the market simply dilutes your competitive advantage and limits your upside potential.

Diversification is commonly advocated for by traditional investment advisers for two reasons. Firstly, the adviser's circle of competence may not align with the best interests of the client. For example, the adviser may have expertise in tech stocks, but the client has a low risk tolerance and is looking for income. Secondly, the adviser is liable for the performance of the client's portfolio and could be subject to legal action in the event of a large drawdown. Therefore, the adviser is incentivised to protect against downside risk through diversification.

My portfolio did not include any mining stocks for a long time, so I thought I should diversify by buying some stocks in that industry. I ended up buying stocks that did not necessarily meet my investment criteria simply to diversify my portfolio. What's worse is that these stocks were outside my circle of competence. I didn't fully understand what made them move, let alone how to value them. Investing should be objective, and this preconceived notion that I should diversify my portfolio biased me and caused me to buy stocks that I shouldn't have.

How many stocks should you aim for in your portfolio? This depends simply on how many stocks you can mentally keep track of at one time. To give you an idea, my portfolio typically contains about 10 to 12 stocks because that is the maximum number of stocks I am willing to keep in mind at once.

In conclusion, the appropriate level of diversification for your portfolio is completely up to you. A small level of diversification is always recommended to protect your money from completely disappearing if one of your investments goes wrong. But if you know how to select the right stocks, you want to allocate a high enough portion of your portfolio to those stocks so your returns can benefit.

Summary of Key Concepts

- Systematic risk comes from broad, economic factors and affect the market as a whole.

- Unsystematic risk comes from stock, industry, or sector-specific factors.

- Diversification is the act of reducing the overall risk of your portfolio by buying stocks across different companies, industries, and sectors.

- Systematic risk is always present no matter how many stocks you buy.

- Diversification should not be a reason for you to buy a stock.