Monetary Policy

Central Banks

Central banks are one of the two main institutions that control the economy. The Federal Reserve (the Fed) is the central bank for the United States, and the Reserve Bank of Australia (RBA) for Australia. These institutions are independent to the government and are responsible for promoting the stability of the financial systems in their country. They do this by providing general financial and banking services, issuing the country's currency, and implementing monetary policy.

The Federal Reserve's objective is given by a dual mandate, which is to both achieve maximum employment and maintain price stability. This means the Federal Reserve is responsible for looking after both unemployment and inflation in the US, which are closely related as will see later. The RBA is similarly responsible for both unemployment and inflation in Australia.

The toolbox central banks have for controlling unemployment and inflation is called monetary policy, and includes tools to control interest rates and the money supply.

Interest Rates

Interest rates can be thought of as the cost of borrowing or the return on lending.

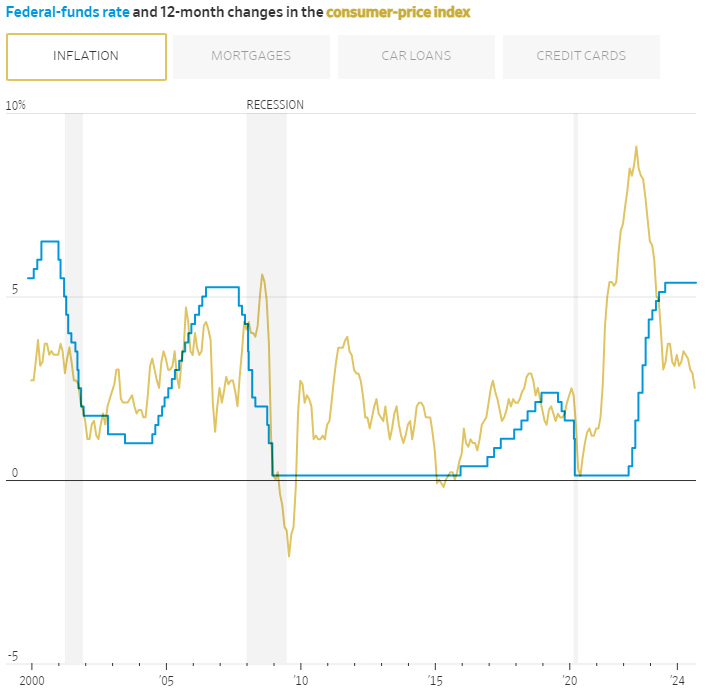

The main way central banks control the economy is through interest rates. Interests rates throughout the economy from the savings rate on your bank account, to mortgage rates, to business loans, to bond yields are all linked. Central banks control all other interest rates by adjusting the cash rate. This rate is essentially the interest rate that banks pay to borrow funds from other banks. This interest rate flows on to the rest of the economy through banks (banks are the central intermediary between lenders and borrowers - when you put money in a bank accout, the bank lends it out to other people and returns part of the interest to you as the savings rate).

When inflation is below target, the central bank lowers interest rates, prompting consumers to borrow (think about credit cards) and increase their spending, causing inflation to rise. When inflation is above target, the central bank raises interest rates, prompting people to cut back on their spending and therefore inflation to cool.

Interest rates also have a special significance when it comes to the stock market. Firstly, when the cost of borrowing is high, the interest owed on loans taken by businesses is greater, directly eating into their profits. Secondly, in high interest rate environments, debt securities such as government bonds provide a greater rate of return, causing investors to switch out of risky investments like stocks (recall that investors are risk-averse and prefer lower risk for approximately the same return). Both these factors combine to mean that high interest rates are generally bad for stocks.

Money Supply

The money supply refers to the total amount of money, including paper money, coins, and bank balances, in circulation. Consumer spending and investment are closely related to the money supply. When the money supply is high spending and investment are encouraged, and vice versa. When interest rate cuts are not available (perhaps because the cash rate is already too low), central banks can increase the money supply through a process called quantitative easing (QE).

Under quantitative easing, the central bank injects money into the financial system by purchasing large volumes of securities like government bonds from banks and other institutions. This increases the cash reserves of these institutions, who are then encouraged to increase lending and investment to other sectors of the economy.

The act of purchasing large amounts of bonds also pushes the price of those bonds up via supply and demand and decreases yield. Therefore, rembering that all interest rates are connected, QE also indirectly lowers interests. However, this effect is secondary to the main objective of QE, which is to increase the money supply.

Effect of Monetary Policy

Central banks and monetary policy exist to pull the economy back from the extremes. What I mean by this, is that when inflation or unemployment deviate significantly from their targets, central banks will act to correct them.

For context, the Federal Reserve's target inflation rate for the US is 2%, while the Reserve Bank of Australia's target is a range between 2% and 3%.

In 2020 and during the Covid-19 pandemic, US GDP shrank by 5.3% and 28% in Q1 and Q2 respectively. Inflation slowed to near 0% and unemployment rose to nearly 15%. In response, the Federal Reserve simultaneously cut interest rates to between 0% and 0.25% and launched one of the largest quantitative easing (QE) programs in history (since interest rates were already near zero, they had to rely heavily on QE). As the pandemic subsided, the massive increase in the money supply contributed to a major rebound in consumer spending. Inflation went from one extreme to the other, as it spiked to over 9% in June 2020. The Federal Reserve then had to rapidly increase interest rates in order to bring inflation back to its 2% target.

The effect of the pandemic on economies globally would have been much worse and certainly more prolonged if not for central banks.

Summary of Key Concepts

- Interest rates can be thought of as the cost of borrowing or the return on lending.

- The goal of central banks is generally to control inflation and unemployment in the economy.

- Central banks can control the economy through interest rates and quantitative easing.