GDP & Economic Cycles

Gross Domestic Product (GDP)

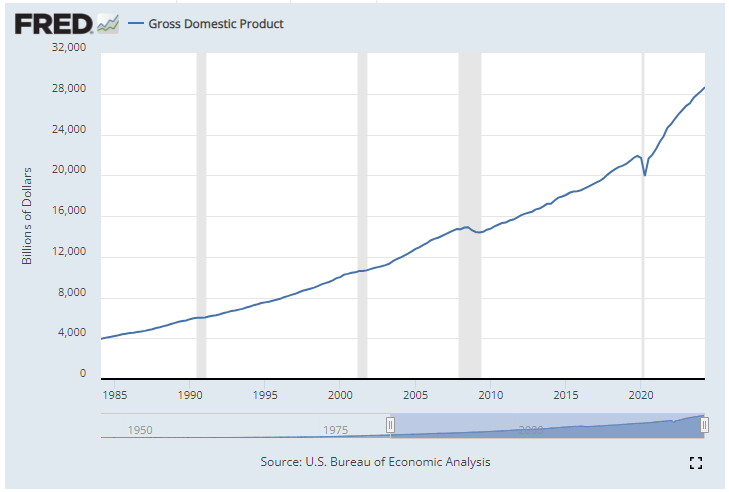

Gross Domestic Product (GDP) is how we measure the performance of the economy.

We know that the economy effects the companies we invest in. We know that a strong economy is good and a weak economy is bad. But how do we measure the economy and determine whether it is expanding or contracting?

Gross Domestic Product or GDP is the total market value of all the goods and services produced by an economy during a specific time period. It can be thought of as the total level of activity or productivity in an economy.

GDP is usually estimated every quarter by a government agency, such as the Bureau of Economic Analysis for the US and the Australian Bureau of Statistics for Australia. Governments, corporations, investors, and media pay close attention to GDP announcements because of the implications it has for the economy.

Calculating GDP

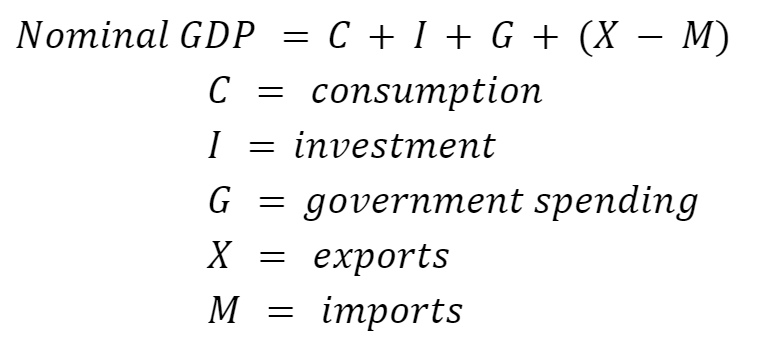

The most common way of measuring GDP is called the expenditure approach which follows the formula depicted below. This method splits the economy into four distinct spending groups and sums the total of each of three groups. Everything produced by the economy is accounted for by one of the spending groups, such that the sum is equal to the value of production.

The first group in the formula is consumers, which refers to households or private individuals like you and I. We spend money on every goods and services like groceries and petrol, and discretionary items such as jewellery or even Netflix. As we will see later, consumer spending is a very important component and undoubtedly has the largest influence on the economy of each of the groups.

The second group is businesses. Business spending is represented by investment in the above formula. It includes capital expenditure (recall the chapter on the balance sheet) and even "investment" in goods or services that did not sell during the period and went to inventory. This is important because an item, like a pair of shoes, that was manufactured during the period but not sold will not appear in the consumption part of the equation. Since our goal is to measure productivity in the economy, not counting items like this would be problematic. The solution is that they are included in investment.

The third group is the government. Government spending includes spending on infrastructure, defense, education, and healthcare. Government spending is one of the ways in which the government can influence the economy, coming under fiscal policy which we will discuss later.

The final group is external economies or countries. Other countries can buy goods from the home country which would otherwise be recorded in the consumption part of the equation. These are accounted for in the exports part of the equation. At the same time, domestic consumers can buy goods from other countries which would inflate the consumption part of the equation. These are accounted for by subtracting imports from the equation. Exports and imports are sometimes simplified to net exports and represented by NX in the equation instead of X - M.

One of the problems with nominal GDP, which is what the above equation provides, is that it is influenced by price. For example, businesses could raise the price of their goods which, assuming the same number of units are sold, would result in a higher GDP reading even though productivity has not changed. To get around this we use real GDP, which is an inflation-adjusted version of nominal GDP. Real GDP is calculated by selecting a base year, and then scaling nominal GDP up or down corresponding to the inflation experienced from that year to the period being calculated. We will cover inflation in more detail later.

Economic Cycles

The economy general expands over time due to things like population growth, access to resources, and improvements in technology. The average annual GDP growth rate in the US is about 3.0%. Emerging economies, meaning the economies of developing countries, tend to grow faster due increasing industrialisation, integration with global markets, and improving financial and regulatory conditions. The average annual GDP growth rate of these economies is between 6% and 7%.

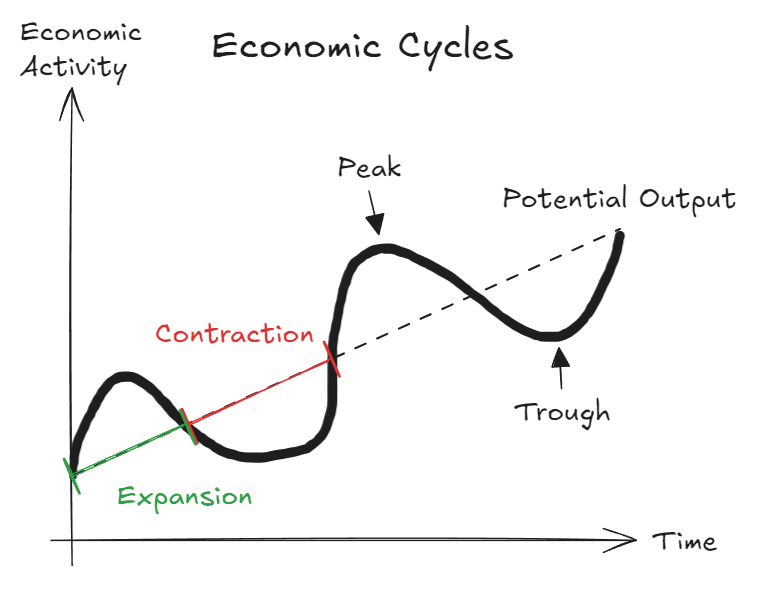

The output that an economy would theoretically produce at its most sustainable level is called potential output. Potential output generally rises over time with technological innovation, population growth, and access to resources. Actual output fluctuates around potential output in periods of expansion and contraction known as the economic cycle.

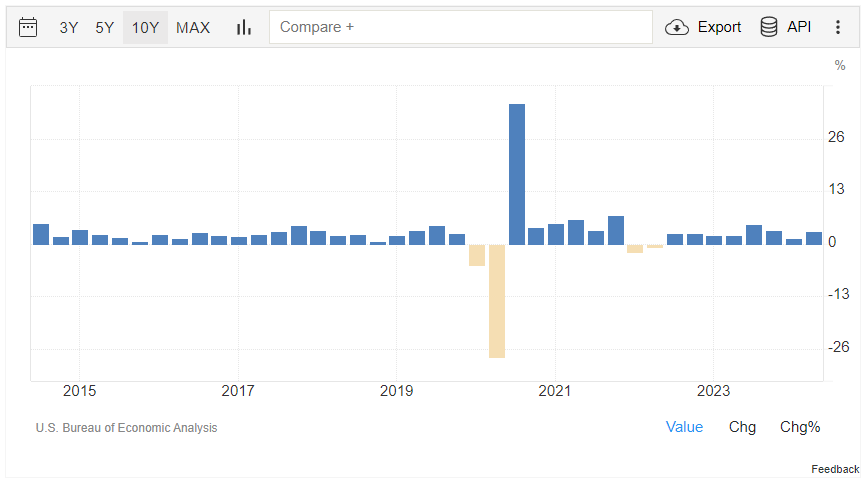

Economic contractions may be the result of many things, from a financial crisis like the GFC or a pandemic like COVID-19. Whatever the catalyst, a contraction results in reduced economic output which means corporate sales decline, individuals lose their jobs, and investors lose their money.

For context, since 1950, the average length of an economic cycle has been about five and a half years. However, cycles can be much shorter or much longer than this. For example, the economic cycle from peak to peak lasted only 18 months between 1981 and 1982. And following the GFC, the economy expanded for 146 months from June 2009 to February 2020.

Most high-school textbooks would define a recession as two consecutive quarters of negative GDP growth. However, a government agency is usually responsible for officially declaring a recession. In the US, that agency is the National Bureau of Economic Research (NBER). The NBER defines a recession as a "significant decline in economic activity... that lasts more than a few months", which does not directly equate to the common yardstick of GDP declining for two consecutive quarters.

This is an important distinction to make because in 2022, US GDP declined by 2.0% in Q1 and 0.6% in Q2 which would technically qualify as a recession. However, the decline was either not significant enough or widespread enough for the NBER to declare a recession.

Simply declaring a recession can often have a negative impact on the economy as it can cause consumers to decrease spending and businesses to adjust their hiring or investment plans.

Consumer Spending

Consumer spending is the total value of all the goods and services purchased by private individuals and, as hinted at above, is possibly one of the most important factors in the economy. It is essential because it directly determines the demand for goods and services within the economy and therefore the profitability of businesses.

When consumption is high, spending, especially on discretionary items, and business profits are high. This has a flow-on effect back to individuals as employment and wages rise, both of which enable consumption to increase further. Higher business profits also increases the wealth of shareholders, which can further boost consumption. The government also benefits from increased business profits through taxation, which it can then deploy back into the economy through government spending.

On the other hand, when consumers cut back on their spending business profits decline. This causes the feedback loop from above to work in reverse and the economy to contract.

When consumers aren't spending they are saving, and one of the biggest reasons to save is the anticipation of a financial shock. If consumers expect to experience financial hardship in the future they will cut back on spending in order to save. This means the anticipation of a shock alone (whether justified or not) can cause the economy to slow because of decreased consumption.

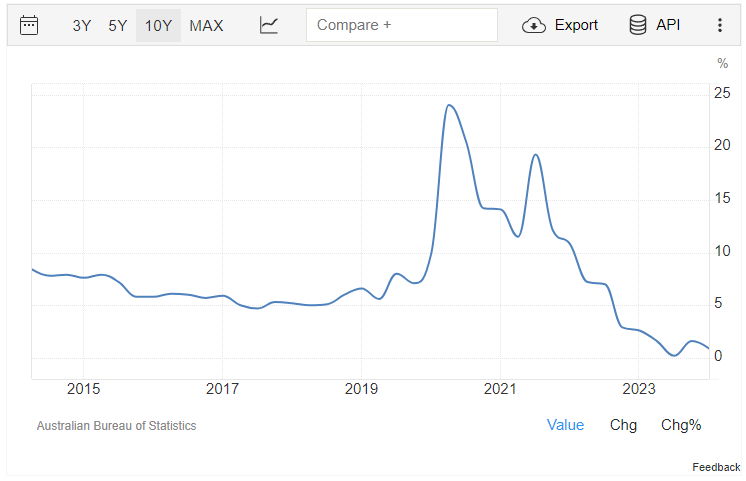

The savings rate is the proportion of income saved relative to total household income during a specific time period. During Covid, the savings rate rose to over 20% in Australia, as seen in the chart below.

So how does consumer spending affect the stock market? Low consumer spending is not good for any business, but will impact each sector differently. The sector that suffers the most is consumer discretionaries, which includes non-essential and luxury item providers. On the other hand, businesses in the consumer staples, healthcare, and utilities sectors don't suffer as much as these are all necessary expenses of the consumer.

Summary of Key Concepts

- Gross Domestic Product (GDP) is a measure of the level of productivity in the economy.

- The economy cycles through times of expansion, contraction, peaks, and troughs.

- Consumer spending is the most important driver of economic activity.