Cashflow Statement

Cash Flow Statement

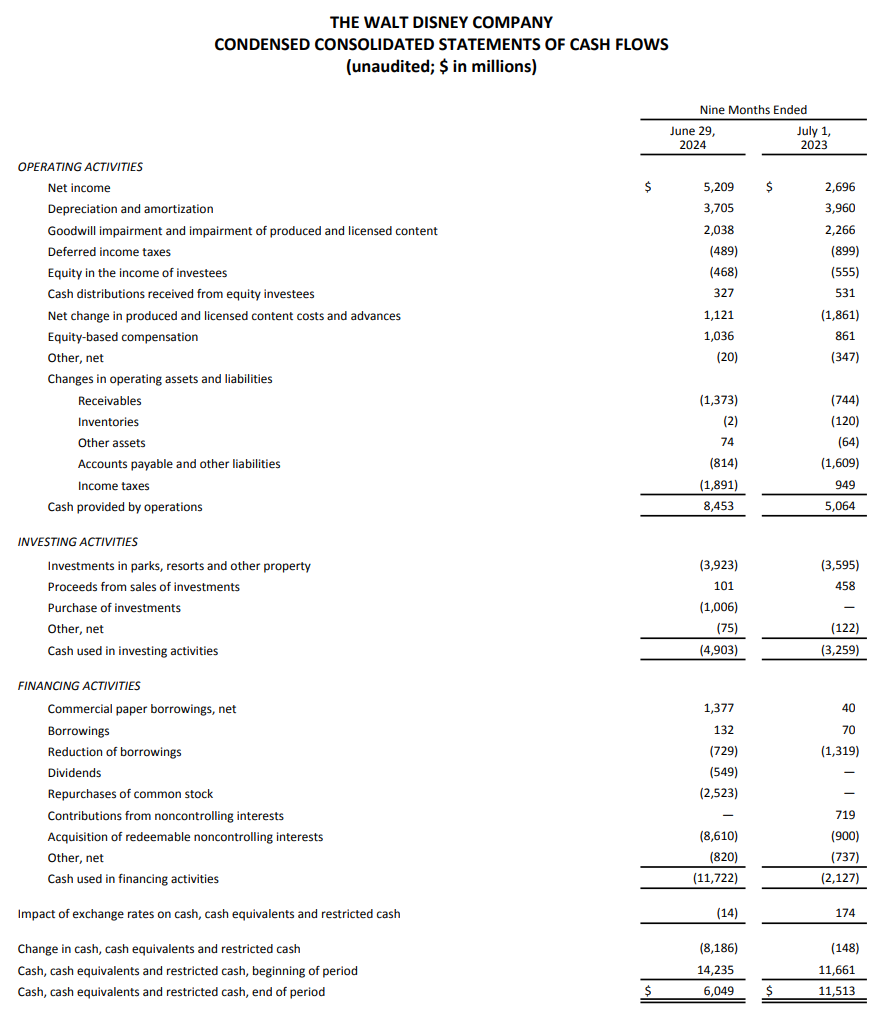

The third of the financial statements provided by a company is the cash flow statement. It is a snapshot of the inflows and outflows of cash over time.

Cash is required to meet immediate obligations, invest in growth opportunities, and maintain operational efficiency. Understanding where it comes from is vital to assessing financial health.

Cash is extremely important because it's what you use to pay for things. A company may have a lot of assets like inventory or account receivables, but these can't be used to pay its employees, suppliers, lendors, or, most importantly, shareholders.

Cash Flow Statement versus Income Statement

If you are like me when I first heard about the cash flow statement, you will be wondering what the difference is between it and the income statement. The income statement shows money coming in as revenue and money going out as expenses. What more is there?

In fact, accounting is a 500 year old practice and the cash flow statement wasn't used for much of that time. It didn't become a requirement under US accounting standards until 1988. Before the cash flow statement was introduced, companies would suddenly go bankrupt even though net income was sufficiently high to cover their debts. Investors relying on the income statement were thoroughly confused.

The difference lies in how money flows are recognised. The income statement records revenue and expenses when they earned or incurred, not when the money is actually received. This is called accrual accounting. The cash flow statement records inflows when money is actually recevied and outflows when it is actually spent, which is called cash accounting.

There are a few items that can cause earnings to deviate from cash flows.

- Depreciation and amortization (D&A) - any changes in the value of fixed assets are deducted from earnings on the income statement but do not result involve any outflow of cash.

- Accounts receivable (AR) - when a company delivers a good or service before receiving payment, the amount owed to the company is added to accounts receivable and recorded as income even though no cash has been received.

- Unrealised Gains or Losses - when the company owns an asset that has increased in value, the gain is recognised as income even if the asset has not yet been sold.

Operating Cash Flow (OCF)

Operating cash flow includes any changes in cash that are considered part of the core operations of a business, like sales, wages, marketing, and taxes.

Operating cash flow is calculated by starting at net income (from the income statement), which already includes operating expenses, and adding back all the non-cash or non-operating items. For example, depreciation and amortization which was deducted from income on the income statement is added back, which has the effect of removing it from the resulting figure. This process is demonstrated by the sample cash flow statement below.

Operating cash flow is important because it shows how much cash the core business, that is, what it does on a day to day basis, is generating.

It is also good to compare operating cash flow to net income to determine the portion of earnings that are cash-based. If operating cash flow is significantly lower than net income, that indicates that a high portion of earnings are non-cash. This is a bad sign because, as mentioned above, businesses can't pay its employees, suppliers, etc. without cash.

Investing Cash Flow

All businesses must invest in physical assets like land, equipment, or machinery to operate. It may even acquire other businesses, or choose to put its spare cash to use and buy shares or other assets. These activities are not considered regular or part of the day to day operations of the business, and are classified as investing cash flows.

Investing is how companies grow. If a business wants to grow over the long term it puts its spare cash into things like stores, factories, equipment, or technology so that it can improve its operations in the future. For that reason, investing cash flow is often negative.

If investing cash flow is positive, that means the company has been selling assets. This is not necessarily a bad sign on its own. Maybe some investments matured, or the business has decided to move some of its cash around. If you see a positive investing cash flow, do some research and try to find if there was something the company did in that period to explain it (try searching for recent company announcements or annual shareholder reports).

It is a bad sign when investing cash flow is positive for multiple years in a row. If a company is selling large amounts of assets for an extended period of time it means two things the business is likely not generating enough cash to support itself. Additionally, assets are usually things the business invested in to support future growth. Selling important assets is limiting to the future growth of the business.

Financing Cash Flow

As we know, there are various things a company can do to raise money. The money raised, whether debt or equity, is not free. Investors who buy shares demand a return on their investment and loans must be paid back with interest. Activities such as paying back debt, paying dividends, or buying back shares are classified as financing cash flows.

Like investing cash flow, a negative financing cash flow is actually normal. Ideally, a business that has been operating for some time receives all the cash it needs from its core operations, so there is no need to raise capital through external sources. However, sometimes businesses want to make a large purchase, such as acquiring another company, in which case it is often appropriate to raise more money. If you see positive investing cash flow, try to find out what the company intends to use the cash for.

Free Cash Flow (FCF)

Free cash flow is the cash generated from the core business after accounting for the amount spent to maintain, acquire, or upgrade its physical assets (PP&E on the balance sheet). The money spent on physical assets is called capital expenditure or capex.

Capital expenditure is an important expense because businesses require some amount of physical assets to operate. It is not included in operating cash flow, meaning that operating cash flow does not provide a full picture of what running the business is really like.

A disadvantage of free cash flow over operating cash flow is that capital expenditure is not necessarily uniform over time, as the company could spend more on upgrades or acquisitions of physical assets in one period than the other. This means free cash flow can sometimes appear less than it otherwise would be. The key is to look at the trend in free cash flow over the long-term.

Free cash flow is not usually included in the cash flow statement because it is not mandatory to be reported. It requires calculating capital expenditure, which has a simple formula you can use. However, providers like Yahoo Finance or TradingView often provide free cash flow so you don't have to calculate it yourself.

Summary of Key Concepts

- Cash is required to meet immediate obligations, invest in growth opportunities, and maintain operational efficiency. Therefore, understanding where it comes from is vital to assessing financial health.

- Various non-cash items, such as D&A, that appear on the income statement cause net income to not necessarily equal cash flow.