Business 101

What makes a good business?

Making money in stocks requires a lot of things of you. One of those things is a strong business sense. When you own a stock you are literally a part owner of the business. While your role in the business is passive, meaning you don't participate in any of the day to day decision-making, you must put yourself in the shoes of an executive director and think critically about it. You must ask yourself, "if I were to start a business, is this one I would want to start?" and "is this a business I really want to own?"

To answer these questions, we have to know what separates good businesses from bad ones. Before we even get to the income statement and balance sheet, there are important qualitative factors that we should consider to help us determine the quality of a business. Almost everything else, from sales and earnings growth to the profit margin, is entirely dependent on these factors. What appears in the financial reports is less important than understanding these qualitative factors (although not completely irrelevant).

Product

Look for businesses that sell products that people love now and will continue to love into the future.

Product is the single greatest indicator of a company's success. In order to be successful a company must have a product that people love and demand. It is a product that satisfies a need, makes people’s lives better, and will do so year after year into the future. If a company has that, everything else will follow.

Think of Apple. Back in 2007 the company wasn't in the best financial shape, but it developed the iPhone. And Netflix. Netflix had mountains of debt, and spent more than they earned for years. But it developed Netflix. You get the idea.

Identifying revolutionary products like these is much easier said than done. For example, former Microsoft CEO, Steve Ballmer, famously laughed at Apple's iPhone and said that it is "the most expensive phone in the world, and it doesn't appeal to business customers because it doesn't have a keyboard." (This quote also shows that CEOs are not necessarily any smarter than us). The company's co-founder, Bill Gates, later admitted that not getting into the smartphone market was the "greatest mistake ever made." Another famous story is how Blockbuster rejected a deal to buy Netflix in 2000 for $50 million. Today, Netflix is worth $300 billion and Blockbuster no longer exists.

"If you aren't thinking about owning a stock for ten years, don't even think about owning it for ten minutes." - Warren Buffett Part of being a good businessperson is having foresight. You have to be a futurist, meaning you must study the trends around you and use them to anticipate what might happen in the future. Ask yourself "What will the future look like? Will electric vehicles replace the traditional auto industry? Will the demand for energy keep going up? Will artificial intelligence replace 90% of jobs?" The Blockbuster executives should have asked themselves "will people continue renting movies in store when they can stream them directly from their couch?"

Economic Moat

The key to investing is [...] determining the competitive advantage of any given company and, above all, the durability of that advantage. - Warren Buffett

An economic moat refers to a company's ability to maintain market share and protect its profit against competitors, just like the moat in a castle prevents enemies from getting in.

According to Morningstar, an economic moat can come from any of the following five sources.

- Network effect. This effect occurs when the value of a product or service increases the more people use it. Examples include Amazon, Facebook, Visa, Mastercard, Uber, and Shopify.

- Intangible assets. These include patents, brands, licences, and other protections that prevent compititors from duplicating a product. Patents are very common in the pharmaceutical industry, where the developers of new drugs are awarded patents to protect their economic interest and incentivise innovation.

- Cost advantage. This occurs when a company can produce a product at a lower cost than its competitors, allowing it to undercut competitors on price. Examples of companies with cost advantage include Walmart in the US or Woolworths in Australia, both of whose scale and extensive distribution network allows them to operate cheaper than smaller competitors.

- Switching costs. This occurs when it is too expensive or difficult to switch to a competitor's product. For example, Apple is said to have high switching costs because it is difficult to move contacts, photos, etc. to competitors' devices. Another example of this is Adobe, whose software has become the standard in graphic design such that most students are taught how to use it and learning anything else would be difficult.

- Efficient scale. This occurs when a niche market is served by one or a few companies such that it may not be profitable for competitors to enter. This commonly occurs in telecommunication, utility, and infrastructure industries where costs to enter are significant. For example, Union Pacific owns the largest public railroad in North America and is protected because of the costs involved in laying new railroad across significant portions of North America. Another example is APA Group, which owns a significant portion of energy infrastructure assets along the east coast of Australia.

Monopolies

In the most extreme instances of economic moats, a company can achieve the status of a monopoly. A monopoly refers to a business that has exclusive ownership or control over the market for a product. In other words, they are the only company in the market or their market share is so significant that they can effectively control quantity and price. Consumers are essentially forced, whether by default or lack of other options, to purchase from the dominant market player.

A monopoly is the ultimate form of economic moat and is essentially a guarantee of success. You should look for businesses that resemble monopolies.

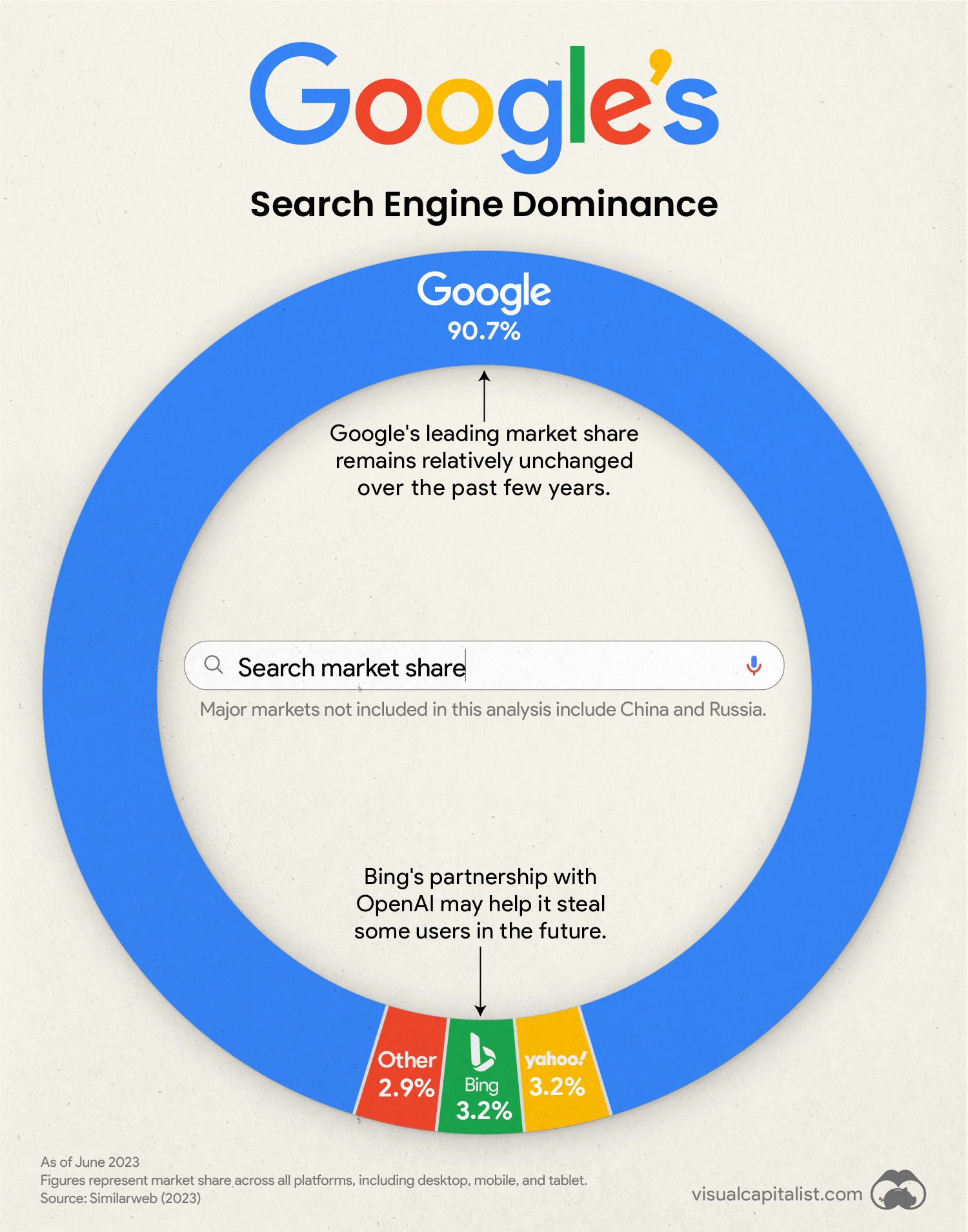

Perhaps the most prominent example of a monopoly today is Google, which dominates the search marketplace with a 90% share.

Monopolies can charge high prices because consumers have no other options to switch to. Because of this, most countries have antitrust regulations in place to prevent the abuse of dominant market positions to harm competition.

This has caused problems for Google, as a US judge recently ruled that Google operates an illegal monopoly and has engaged in "anticompetitive, exclusionary, and unlawful conduct to eliminate or severely diminish any threat to its dominance over digital advertising technologies." This finding could lead to significant penalties for Google's parent company Alphabet, including potentially being forced to breakup.

Most of the tech giants (Apple, Microsoft, Amazon, Google, and Facebook) have faced similar scrutiny over monopolistic practices that have been much of the reason for their success. Many have faced similar suits, but the suit against Google is the first real success and potentially paves the way for prosecutors to target some of the others.

Some more examples of (legal) monopolies or near-monopolies aside are below.

- ASML. Controls up to 90% its market and is the world's only producer of ultraviolet lithography systems.

- Intuitive Surgical. Controls nearly 80% of the global robotic surgery market.

- Boeing and Airbus. Together control over 100% of the global aeroplane manufacturing industry (when there are two dominants companies it is called a duopoly).

- Coles and Woolworths. Together control over 70% of the Australian supermarkets.

Disruptors

Another type of business to consider is the disruptor. These are usually younger or smaller companies that challenges existing norms or industry standards by doing things differently.

Netflix was a disruptor in the entertainment market from 2000 to the early 2010s. In this case, challenging the industry norm was a huge success. Today, I would no longer classify Netflix as a disruptor since the market is full of streaming services that essentially copied it.

Customer Loyalty

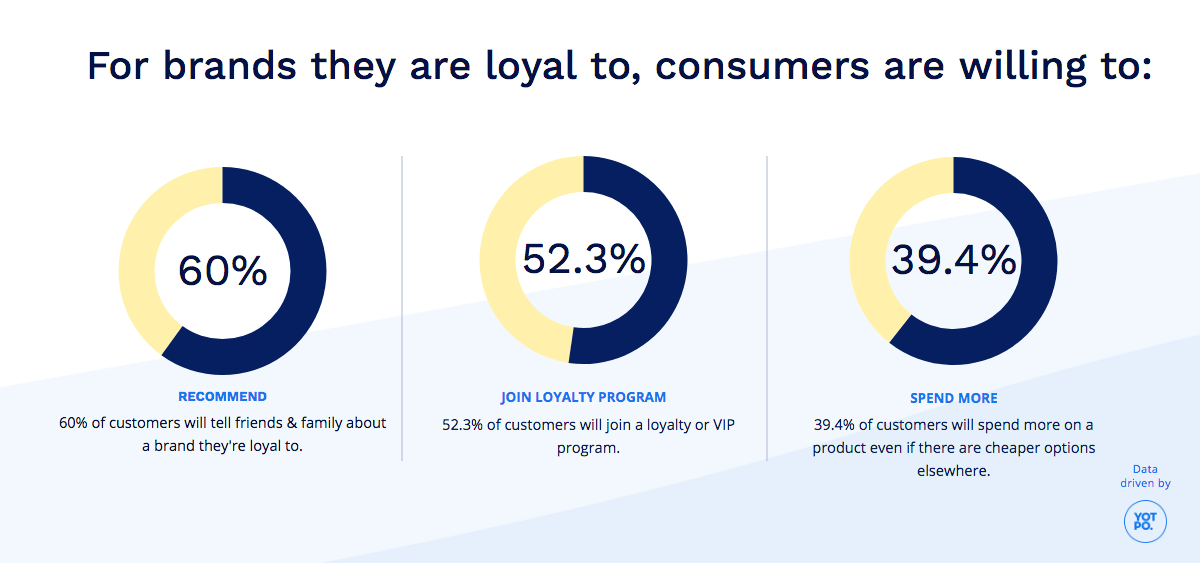

Perhaps more important than having a superior product is having a loyal customer base. Customer loyalty is the long-term commitment of customers to continually purchase from a business or benefit it in any other way. Having loyal customers acts as an economic moat because they are drawn to purchasing from a business even when the product is worse, more expensive, or less convenient.

Customer loyalty is one of the main advantages established businesses have over younger ones. Habits are hard to break, so it is generally more difficult to convince a consumer to stop purchasing from a brand they are familiar with in favour of one they are not. For this reason, it is up to five times cheaper to retain an existing customer than acquire a new one. Additionally, loyal customers tend to help grow the business by referring friends and family. This is why it can be difficult for startups and younger businesses to steal customers from legacy ones.

Vertical and Horizontal Integration

Businesses looking to expand have a couple of choices. They can continue to focus on their core product, perhaps making gradual improvements or expanding geographically. This is likely the strategy of younger businesses and disruptors who have a great product and simply need to get it in front of more people. However, this method becomes more and more difficult with time as the market becomes saturated. At some point, businesses have to look at expanding beyond their core product, and two ways of doing this are vertical and horizontal integration.

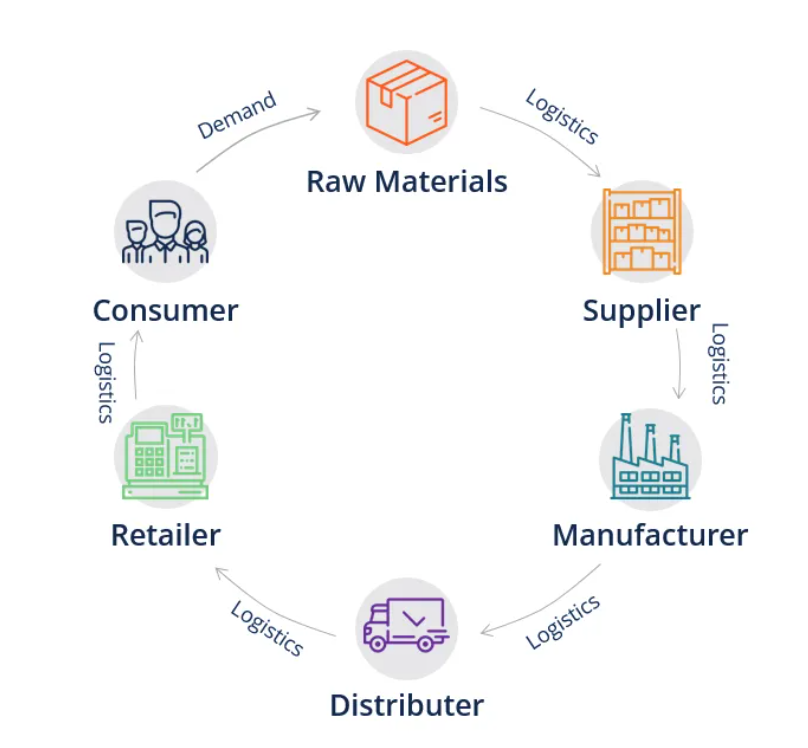

Vertical integration refers to acquiring businesses that operate at different levels of the supply chain. This significantly reduces costs to the business by removing third parties that the company would otherwise have to pay to deliver its product. For example, Netflix is vertically integrated because it produces its own original content which it then distributes via its streaming platform. This means that, for the content it produces, it does not have to pay ongoing fees for streaming rights.

On the other hand, horizontal integration refers to acquiring businesses that operate on the same level of the supply chain in the industry. This can provide access to a broader customer base, increase control over the market, and reduce costs through economies of scale. For example, Disney acquired 21st Century Fox in 2021 which increased the company's control of the supply level of the entertainment industry and therefore the number of titles it could stream via its Disney Plus platform.

Runway for Growth

We generally want to invest in companies that can grow their earnings and thus their share price over time. A runway for growth is a clear path through which the company will sell more of its product in the future. This can be anything, from increasing awareness or adoption, to continued innovation, to changing consumer preferences. Anything that reasonably provides a dimension for the company to expand into is a runway for growth.

To demonstrate what I'm talking about, below is the growth runway for some companies you might be familiar with.

- Apple - continued innovation in its devices.

- NVIDIA - increasing demand for AI and cloud applications.

- Crowdstrike - increasing occurence and complexity of cyber attacks.

- Airbnb - changing preference towards short-term stays over hotels.

- BHP - continued spending on infrastructure which requires iron ore.

- Mineral Resources - increasing demand for Lithium needed for electric vehicles.

- Lululemon - expansion into international markets.

- Eli Lilly - continued adoption Ozempic drug and a strong research pipeline.

Summary of Key Concepts

- Look for businesses that sell products that people love now and will continue to love into the future.

- Observe the world around you, and identify the trends you see and use them to anticipate what the future will look like.

- Look for businesses with a strong economic moat to protect them from competitors.

- Look for long runways for growth.