The Balance Sheet

The Balance Sheet

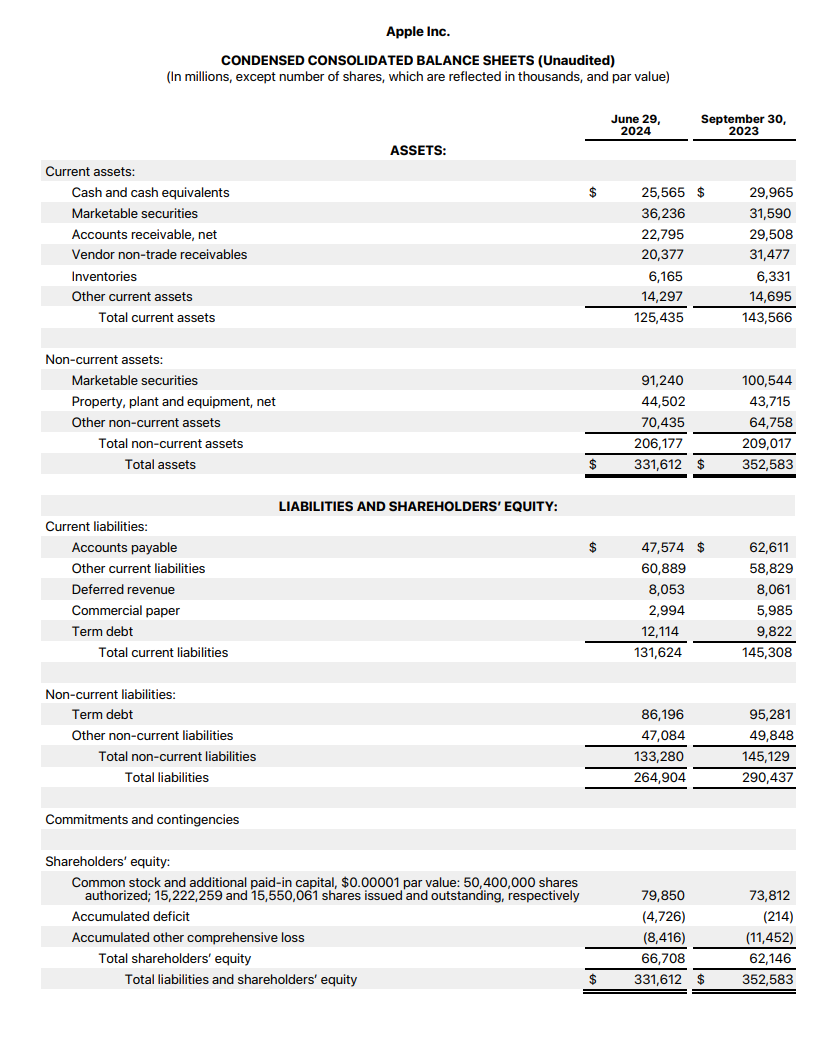

The balance sheet gives an overview of a company’s current financial position. It provides insights into the financial health of the company, meaning how well it can support its operations into the future as well as weather any potential economic downturns that arise.

The balance sheet contains all of a company’s assets, liabilities, and shareholder's equity.

Assets vs Liabilities

An asset is a resource the company owns that will or is expected to generate a positive flow of money in the future. On the other hand, a liability is a resource that will or is expected to generate a negative flow of money in the future. Put simply, assets bring money in while liabilities pull money out.

Shareholder's equity is simply the amount of money belonging to the company's shareholders. If all of the company's assets were sold and all of its debt paid off, i.e. all of the money flows pertaining to them were realised, shareholder's equity is the amount that would be leftover. For this reason, shareholder's equity is also referred to as book value. Below is Apple's balance statement for June 2024 from their investor relation's website.

Tangibility

Assets and liabilities are mostly tangible, meaning you can physically touch them or their value can be easily measured. You can touch a machine or a building, so they are tangible assets. Even money in the bank could be withdrawn for you to touch it if you really wanted.

On the other hand, intangible assets can't be physically touched and their value is less certain. This includes things like branding (think of brand recognition and customer loyalty), patents, and trademarks.

Current and non-current

Assets and liabilities are further categorised based on when the corresponding money flow is expected to occur. An asset or liability is considered current if its benefit or cost is expected to be derived in the next 12 months, and non-current if it’s any longer.

Below are some of the assets and liabilities that are usually included in the balance sheet.

Types of Assets

Cash and Cash Equivalents (CCE)

Cash and cash equivalents is the total value of assets held that are cash or can be readily converted to cash. The term "cash" has a broader meaning here than the paper money you are probably thinking of. In accounting, cash means money in the form of a currency that can be spent, which is most often just money in a bank account.

Cash equivalents are investments the company may hold that can be sold quickly, such as treasury bills or money market accounts.

Cash is extremely important to the health of a business. Cash is what the company uses to pay its employees, its suppliers, its marketers, and its investors. It is so important that it gets its own separate financial report, called the cash flow statement, detailing where it comes from and where it goes.

We will discuss later how to measure cash and what sort of cash levels to look for.

Accounts Receivable (AR)

Accounts receivable is the money owed to the company by its customers. This occurs when the business delivers goods or services to customers in advance of payment. For example, a manufacturing company may manufacture a product and invoice the customer. The customer may have up to 90 days to make the payment, during which the amount is an account receivable.

In a small number of situations, customers may not pay what they owe to the company. In this case, the amount will be written off as a bad debt. However, 99% of the time the company will receive what it is owed.

Inventory

Inventory is the total value of goods the company has that are available to sell. Retailers typically keeps a high number of goods in storage so that it can readily replace the items on its shelves. Inventory also includes raw materials that go into making the final product, and intermediate goods that are not yet finished.

Property, Plant, and Equipment (PP&E)

Property, plant, and equipment is the total value of the land, buildings, and other physical assets like machinery or vehicles owned by the company. These assets are vital to running the business. PP&E are considered non-current assets because they are not easily, or intended to be, sold and converted to cash.

Types of Liabilities

Borrowings or debt

Borrowings or debt is the amount owed by the company to its lenders. This includes banks and other lenders like bondholders.

Debt allows companies to invest in projects that they otherwise wouldn't be able to. Having some amount of debt is not only expected, but, because of leverage which we will discuss below, can actually be a good thing. Companies carefully balance the amount of debt they carry to ensure it is neither too high or too low.

Another benefit of debt is that the repayments are tax-deductible. This means they are subtracted from income before tax is calculated such that the tax payable is reduced.

We will discuss later how to measure debt and what levels are appropriate.

Accounts Payable (AP)

Accounts payable is the amount owed by the company to its suppliers. This is similar to accounts receivable above, and occurs when the company receives a good or service from a supplier that it has not yet paid for.

Deferred Revenue

Deferred revenue is the value of goods or services the company is obligated to deliver to customers. This occurs when the business receives payment for a good or service that it has not yet delivered. For example, a utility company may receive upfront payment to deliver energy to a customer for the next month. The revenue from this transaction is "deferred" because it has not yet been earned by the company.

Lease Liabilities

Lease liabilities is the total value of the leases held by the company, most often for land or buildings. A lease is a type of contract where the lessee, in this case, the company, uses an asset that is legally owned by another party in exchange for a fixed payment. This is the same thing as when you rent a house from your landlord.

Types of Shareholder's Equity

Equity Capital

Equity capital or stock is the money contributed to the company by shareholders during equity raising events, such as the IPO or secondary offerings.

Retained Earnings

Retained earnings is the amount of profit that has been accumulated and retained by the company (rather than distributed to shareholders). It is not necessarily kept as cash in the bank, but could have been reinvested in the business or used to payoff loans.

Some Accounting

Assets = Liabilities + Shareholders' Equity

Above is the Fundamental Accounting Equation, which states that total assets must be equal to the sum of total liabilities and shareholder's equity. You will find that balance sheets always satisfy this equation. Intuitively, this makes sense because shareholder's equity is defined as the amount left over after all the obligations pertaining to the company's liabilities are resolved.

We are getting into a bit of accounting here, but I believe this equation has important implications for how we understand the balance sheet and some of the fundamental ratios we will discuss later.

The way to view this equation is that the company's assets must be financed by either debt or equity. For example, if a company wants to build a big factory to manufacture its product, it can get money by either taking out a loan (debt) or issuing more shares (equity). When the factory is built it becomes an asset (PP&E). The increase in assets on the left-hand side of the equation is equal to the increase in debt on the right-hand side, and the equation remains balanced. When the company starts selling the product its bank balance (cash) increases. This time, the increase in assets on the left-hand side is matched by an increase in equity (retained earnings) on the right-hand side, indicating the money belongs to shareholders.

Leverage

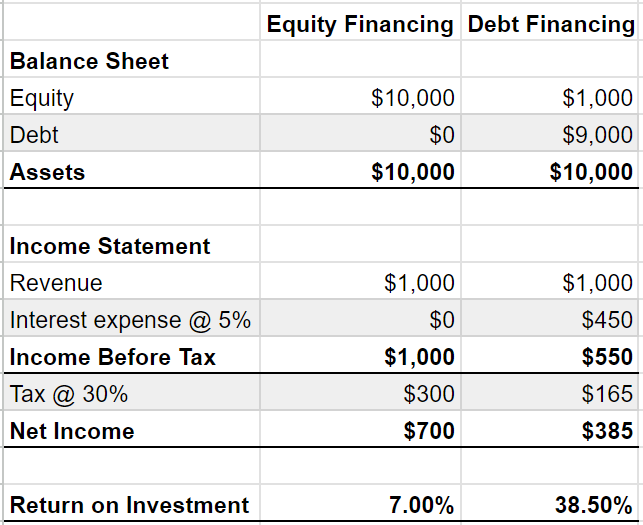

Debt magnifies shareholders' return on investment in both good and bad times.

If debt incurs interest payments, why use debt financing at all?

Debt financing does not require shareholders to invest more in the company. Assuming the company makes enough to cover interest payments, shareholders get to keep all the money left over. This increases the return on investment to the shareholders.

This effect is also referred to as leverage or gearing, alluding to the fact that small changes in input can magnify the outcome.

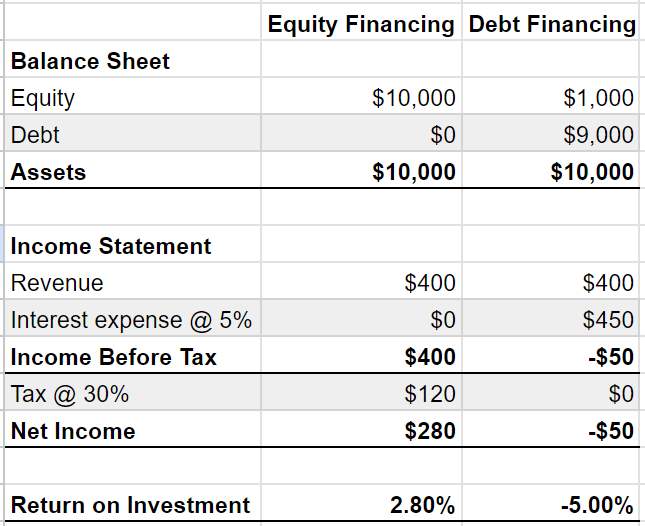

However, leverage is also risky because the same magnifying effect is applied to the downside. Debt must be paid back, so if you don't make enough money in profits to cover your interest you will have to pay it back out of your own pocket. Below is another scenario involving the same two companies, but this time they have a bad year and don't make enough to cover interest costs. Finding the appropriate balance between debt and equity is extremely important.

Above is a comparison between a company that uses 100% equity to finance its operations versus a company that uses 10%. You can see how the percentage return (net income / capital invested) is significantly higher for the latter.

Use the example below to see how leverage affects the return on equity for a company.

| Equity Financing | Debt Financing | |

|---|---|---|

| Balance Sheet | ||

| Equity | $10,000 | $9,000 |

| Debt | $0 | $1,000 |

| Assets | $10,000 | $10,000 |

| Income Statement | ||

| Revenue | $700 | $700 |

| Interest Expense | $0 | $50 |

| Income Before Tax | $700 | $650 |

| Tax @ 30% | $210 | $195 |

| Net Income | $490 | $455 |

| Return on Equity | 4.9% | 5.056% |

Summary of Key Concepts

- The balance sheet shows the company's assets and liabilities at a particular point in time.

- An asset is something that is expected to generate a positive flow of money in the future, while a liability is expected to generate a negative flow.

- The debt to equity (DE) ratio measures the split between debt and equity financing. Companies with high DE ratios can benefit from leverage, which can magnify both shareholder returns and losses.